Gifting and sense of place continue to play key roles in confectionery, says leading retailers

Dubai Duty Free’s strong and steady sales of dates, chocolate-covered dates, Arabic and regional sweets, as well as regional chocolate brands

Gifting and sense of place – along with an increasing awareness of health and wellness issues – continue to play key roles in the confectionery category in travel retail in the Middle East, according to two leading retailers in the region.

Sharon Beecham, Senior Vice President – Purchasing at Dubai Duty Free and Tirthaa Chatterjee, Lagardère Travel Retail Middle East’s Category Manager Food, share their thoughts on key trends.

According to Beecham, Dubai Duty Free’s confectionery category “is predominantly driven by gifting, which makes up 72% of total confectionery sales.” She says most gifting choices revolve around family get-togethers and celebrations, and notes that a “universal consensus among shoppers that buying brands and products that are perceived as valuable gifts on the receiving side is a priority for shoppers.”

Self-indulgence represents just under 5% of sales. “Today’s consumers are well-informed about health and wellness and their shopping is driven by those choices,” Beecham says. “However, when traveling, shoppers usually have different priorities when it comes to consumption or self-indulgence. It is like they have an on/off switch button and use travel as an opportunity to make it a cheat day for self-treating and put aside usual healthy routines.”

She cites research suggesting that confectionery is directly linked to sensory feelings, a good mood that is hard to resist, and notes that health and wellness in confectionery “have not made similar progress in travel retail as they have in the domestic market.”

According to Chatterjee, the impact on confectionery category demand resulting from the growing health and wellness subcategory in food is limited, with the category offering alternatives to mainstream chocolate products. “This could be one of the reasons behind why these two categories can sustain value without impacting each other,” she says. “A customer looking to buy differential/ healthy products opts for chocolate-coated dates and nuts. This is growing the category instead of cannibalizing the sales of confectionery.”

According to Dubai Duty Free, the confectionery category is predominantly driven by gifting, which makes up 72% of total confectionery sales

Digital media and technology

Considering the role of social media and digital technology in the marketing and sale of confectionery products, Beecham describes social media as an “important tool to connect retailers with travelers on an emotional level, while at the same time building awareness and trust before passengers are exposed to travel and shopping experiences.”

Dubai Duty Free uses social media to showcase exclusive product launches, high-profile and seasonal activations, adding links to the retailer’s website page so shoppers can make online purchases.

“We have witnessed customers who are more inclined to shop for Beauty, Electronics, and Liquor products online, while they prefer a personal shopping experience when it comes to confectionery and food purchases,” Becham adds. “Social media then serves as a powerful tool to showcase the offers and raise awareness about the product range we are offering.”

Chatterjee highlights how brands are engaging on social media platforms to drive sales by focusing on travel retail exclusives, differential products and packaging. “The most highlighted category is gifting,” she says.

“Brands are still learning about conversion rates from social media imprint. The use of digital marketing is an emerging trend and brands are opting it to have more interactions and creating value for the category with higher customer engagement, especially with millennials.”

Health regulations and healthier choices

“We have already seen traffic light control systems implemented for food labeling guidelines paving the path in the UK and other countries,” Beecham says. “Europe also has stringent measures for food ingredients, and it is expected that the UAE may implement similar requirements in the near future. Confectionery brands need to stay alert and agile, expecting those changes, and be ready for any such changes.”

She notes that some brands are keen to highlight health and wellness on their packaging, with statements including “Free from Palm Oil,” “Plant Based,” “Lactose Free” and others such as those. “It’s useful to target that limited consumer base that specifically looks for this information on packaging,” Beecham adds.

Chatterjee says Lagardère Travel Retail has established categories to target business in the emerging health and wellness categories and notes a shift in consumer preferences towards healthier choices such as protein bars, nut bars and food products made with dates.

Considering the developing interest in fine foods in travel retail, Beecham says the increasing number of F&B outlets in Dubai International Airport is testament to the growing demand, and Chatterjee underlines the role of sense of place.

“The Fine Foods category is growing significantly due to its sense of place equation in the Middle East, especially in the category of dates and nuts,” she says. “We have seen over 11% growth in Saudi Arabia during 2023 over 2022 in the Fine Foods category. The overall growth trend is very impressive in this category since it plays heavily into gifting and souvenirs.”

Lagardère has made sense of place an integral part of most of its outlets and the company’s global CSR commitments include sourcing more local products

Underlining sense of place

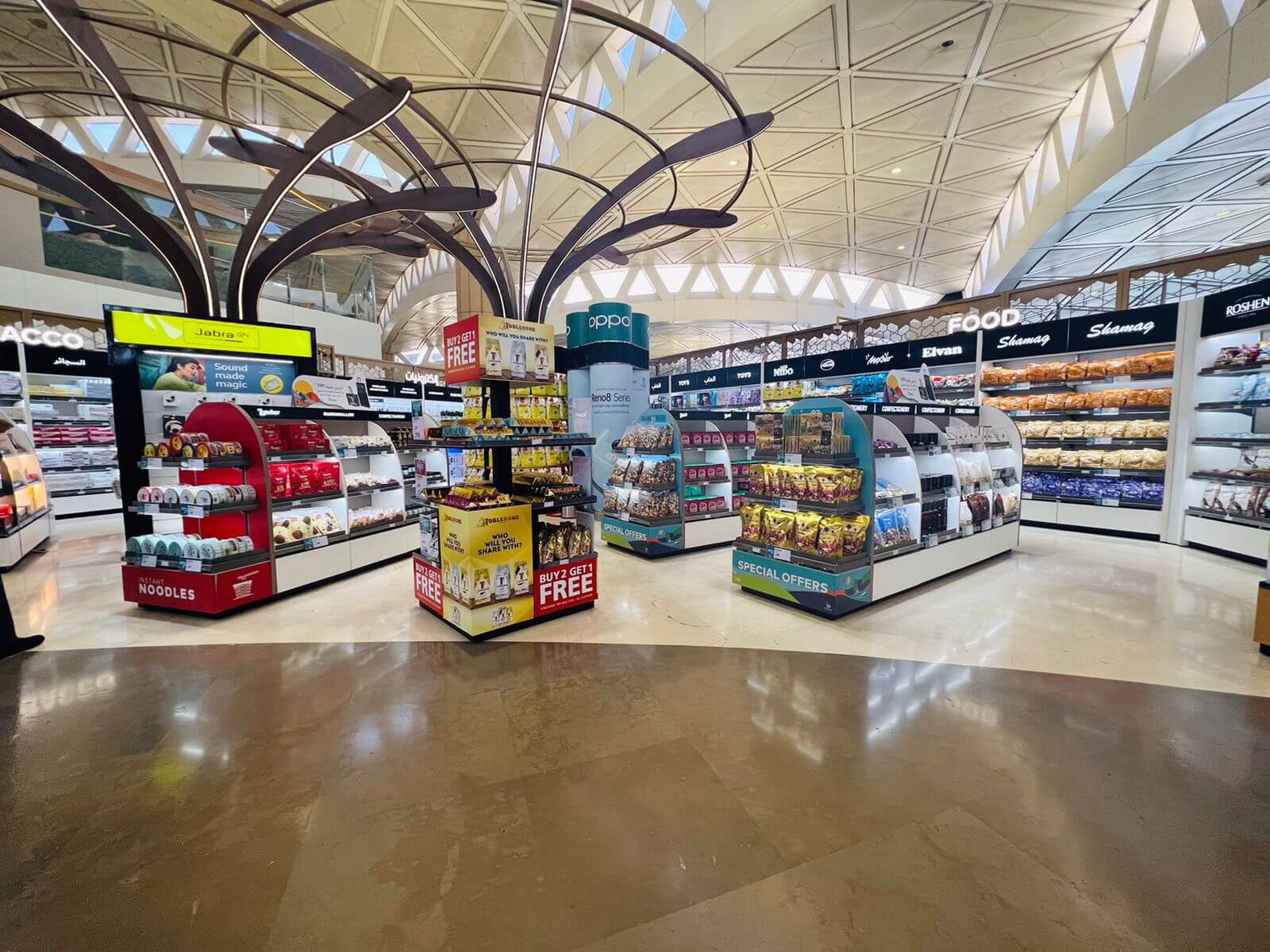

Beecham emphasises Dubai Duty Free’s strong and steady sales of dates, chocolate-covered dates, Arabic and regional sweets, as well as regional chocolate brands. Patchi, Bateel, Al Nassma are just three of the established regional brands that perform well in the travel retailer’s stores. She also underlines the key role of bespoke destination packaging.

Lagardère Travel Retail has made sense of place an integral part of most of its outlets and the company’s global CSR commitments include sourcing more local products. In the Middle East the growing trend in local products is focused on various snacking options made with dates, nuts and dried fruits. “This category is usually price positioned around 20-30% higher than confectionery,” Chatterjee adds. “In travel retail, sense of place products are supporting the growth in the gifting category.”

According to Chatterjee, the impact on confectionery category demand resulting from the growing health and wellness subcategory in food is limited, with the category offering alternatives to mainstream chocolate products

Optimizing confectionery space

Beecham believes merging food with souvenirs and the rest of the fast-moving consumer goods (FMCG) categories could be a strong option in optimizing confectionery space. She also suggests that food service counters offer loose dates, nuts and honey to increase the average transaction value (ATV) of shoppers.

Chatterjee notes a confectionery category shift in consumer behaviour post COVID. “Customers are trying to shrink their budget while staying healthy and the impulse category in confectionery is gaining attention and market share, with small sized gifts introduced at cash tills to capture turnover and convert sales.”

Inflation and its effect on the confectionery category

Beecham says an increasing number of confectionery suppliers are introducing bite-size snacking options to lessen the effects of inflation and higher prices. “High-ticket items and passpacks have already been affected by crossing the acceptable price threshold. We need to reevaluate the composition of these promotional bags to make them more affordable and regain their appeal.”

“Over 2022 and 2023, one of the significant strategies from brands to control price increase has been in the form of decreasing the pack size,” Chatterjee adds. “This is where local confectionery is gaining sales.”