m1nd-set releases latest study of Asia Pacific shopper trends and forecasts

m1nd-set considers latest international pax numbers

Swiss research agency m1nd-set has released its latest Asia Pacific research looking at air traffic performance across the region.

The study draws on data from m1nd-set’s bespoke traffic and shopper behavior analysis tool, Business 1ntelligence Service (B1S), in which air traffic and forecast data are provided in partnership with IATA.

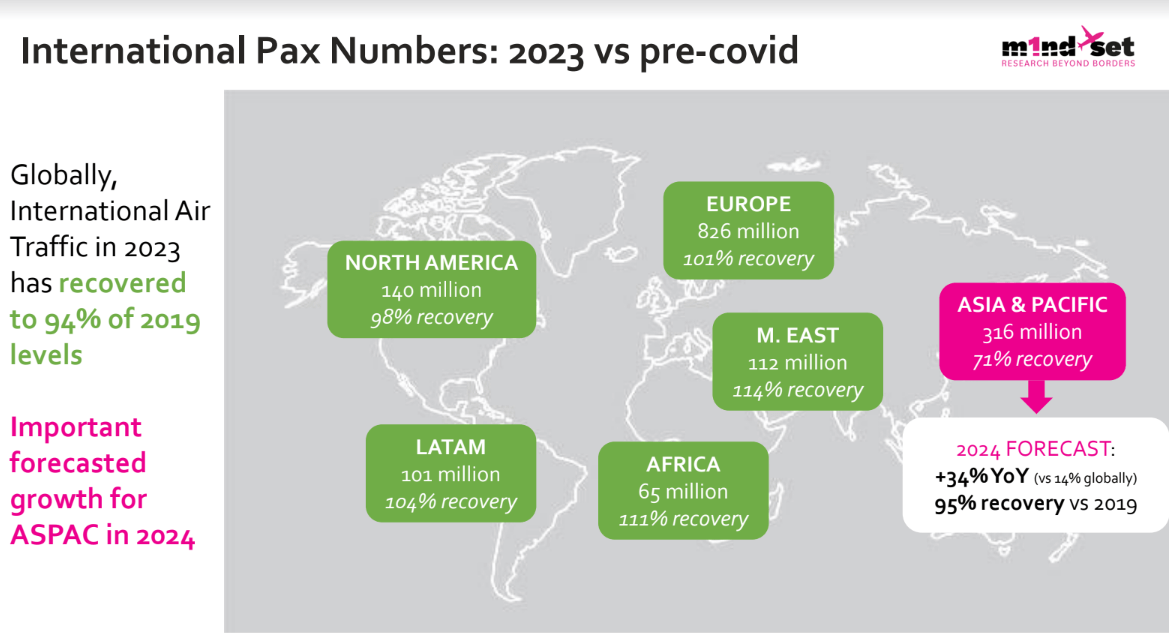

The data shows that while all other world regions except North America had already surpassed pre-covid traffic levels in 2023, Asia Pacific was still only at 71% of 2019 international air traffic, with 317 million international passengers. 2024 will see significantly more robust air traffic growth across the region than the global average however, with a 34% year-on-year growth forecast compared to 14% globally. Asia Pacific international air traffic will still fall slightly short of 2019 levels though in 2024, with an estimated 95% recovery by the end of the year.

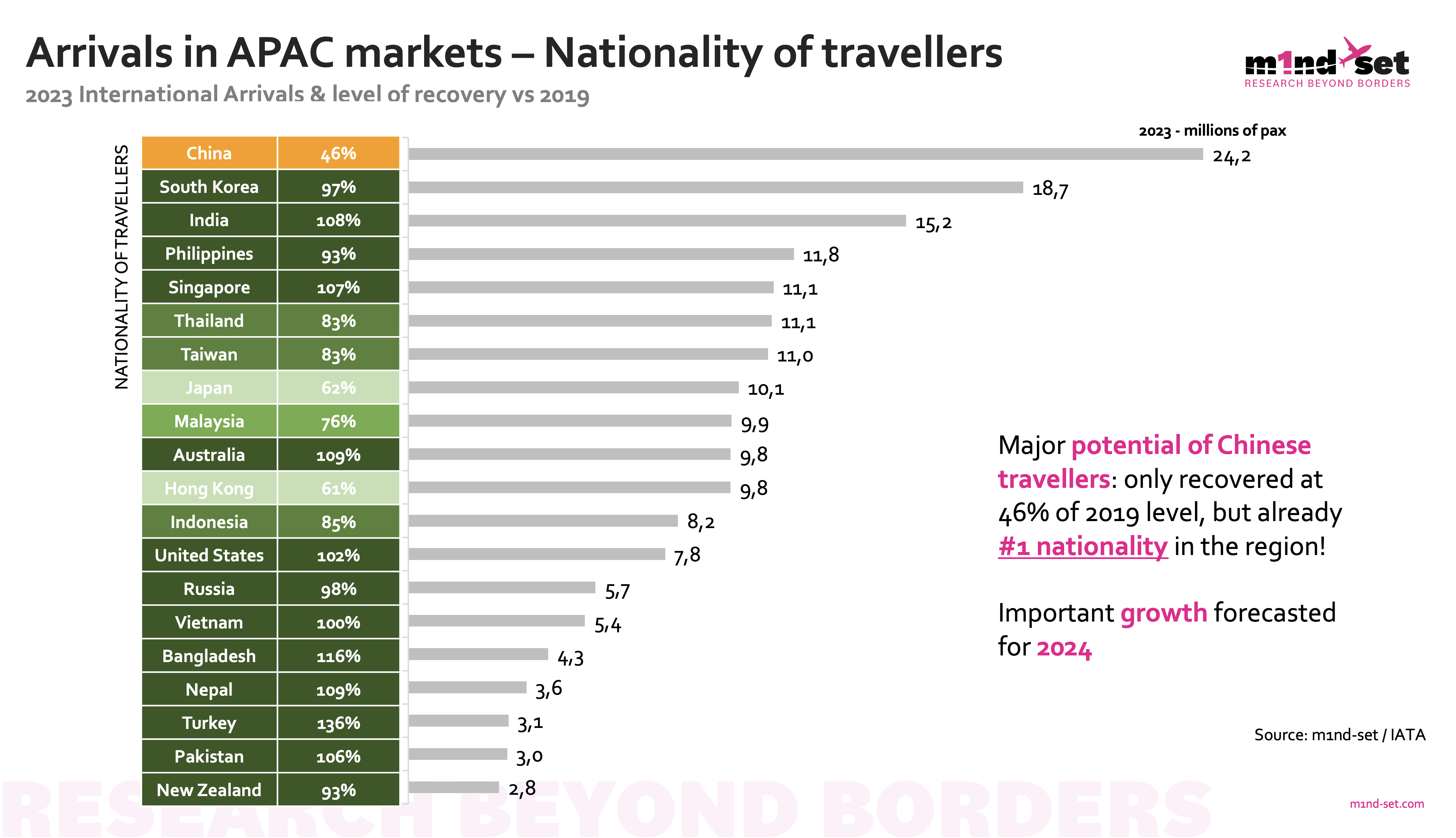

The research provides detailed updates on the recovery levels across each market within Asia Pacific, intra-regional traffic, as well as traffic between Asia Pacific and other regions, the top travelling nationalities within the region and the main foreign visitors to markets throughout the region. Japan, Singapore and Thailand lead the rankings, in terms of passenger volume of foreign visitors across the Asia Pacific. (The rankings are for foreign visitors only and do not include returning nationals.)

Japan received 30 million foreign visitors in 2023, 86% of the pre-COVID level, Thailand 22 million, - 67% of 2019 levels, and Singapore 20 million – 81% of the 2019 level according to m1nd-set’s B1S traffic monitor. Thailand is still lagging at the two-thirds mark, due to its dependency on arrivals from China.

The research reveals that India leads the way in terms of air traffic recovery with 97% of 2019 levels and 10 million foreign visitors. Malaysia follows in second place at 91%, and 12 million foreign nationals arriving in the country. At the other end of the scale are Myanmar, which has only recovered 40% of the pre-Covid traffic and China, with 12 million foreign visitors in 2023, representing 44% of the 2019 level.

The massive growth potential with the Chinese tourism market however is highlighted in the research, which shows that while passenger numbers among Chinese outbound travelers are only still less than half (46%) of pre-Covid levels, in terms of volume, the Chinese already surpass all neighboring markets, and by a considerable distance. More than 24 million Chinese passengers took to the skies in 2023 travelling within Asia Pacific according to m1nd-set. This surpasses second-ranking South Korea by more than 30%. There were just less than 19 million passenger journeys by South Koreans travelling within Asia Pacific in 2023, which is only just short of the 2019 level. m1nd-set forecasts that more than 52 million Chinese passengers will travel within the region, when intra-regional flights by Chinese passengers have fully recovered.

In addition to the China inbound and outbound traffic evolution analysis, the China specific focus within the research also provides an update on how shopping behavior among the Chinese GenZs is evolving.

China and Asia Pacific GenZ behavior will be the focus of the next GenZ RedY Consumer Insights Workshop m1nd-set is co-hosting alongside Blueprint in Singapore on the afternoon of Sunday 12 May at the MBS Expo and Convention Centre. Limited places are available and can be reserved online here.

Improving KPIs among Asia Pacific travelers

The research also draws a comparison between the Asia Pacific region and other world regions on footfall, conversion and spend performance; demonstrating that Asia Pacific is either in line with or above the global averages for each criteria. Footfall in the duty free shops in Asia Pacific is in line with the global average, ahead of the Americas but trailing behind Africa and the Middle East, and Europe. According to the research the purchase rate among Asia Pacific shoppers is two points above the global average and behind Africa & the Middle East.

The research also reveals that average spend is significantly higher than the global average in Asia Pacific, with +US$29, and ahead of Europe and the Americas but trailing the Africa & the Middle East region.

According to the research, Asia Pacific shoppers have a considerably higher tendency to plan their purchases than shoppers from other world regions. 82% of Asia Pacific shoppers plan their duty free shopping. Duty free shoppers from the Asia Pacific region also have an above average tendency to notice touch points before shopping (43% vs 33% on average),

Dr Peter Mohn, m1nd-set Owner & CEO, commented, “These findings underline the importance and potential impact of well targeted pre-travel marketing about the duty free shopping experience and offer. If media campaigns and marketing messaging are designed to reach Asia Pacific shoppers while they are in the stage of planning their trip, they will inevitably have a positive influence on their decision to purchase, and more so than among shoppers from other regions.”

Mohn added, “While performance is relatively strong compared to the global averages across each performance criteria, there is still room for improvement if Asia Pacific travel retail stakeholders want to take the top rank and surpass performance in Africa and the Middle East. To attract more shoppers from the region into the shops, marketing campaigns need to highlight that duty free shopping gives them an opportunity to purchase products that are new or different to those found downtown or online. Asia Pacific shoppers have a greater tendency to purchase products they had never purchased before when shopping in duty free”.

The research reveals that the main appeal factor among Asia Pacific travelers, impacting their decision to enter duty free shops is the value aspect. The convenience of duty free shopping and the fact that it gives something to do while killing time waiting for a flight are other key attractions cited by Asia Pacific travelers. The research also highlights the importance of sales staff as effective touch points to increase conversion and spend among Asia Pacific shoppers as staff engagement levels in the region are significantly higher than the global average. The impact of the interaction in the region also outperforms the global average, m1nd-set reports.