DFWC and m1nd-set share global duty-free shopping trends through KPI Monitor insights

The Duty Free World Council (DFWC) has released the results of its year-on-year KPI Monitor for 2023; the research shows significant shifts in how international consumers gather information on duty-free shopping.

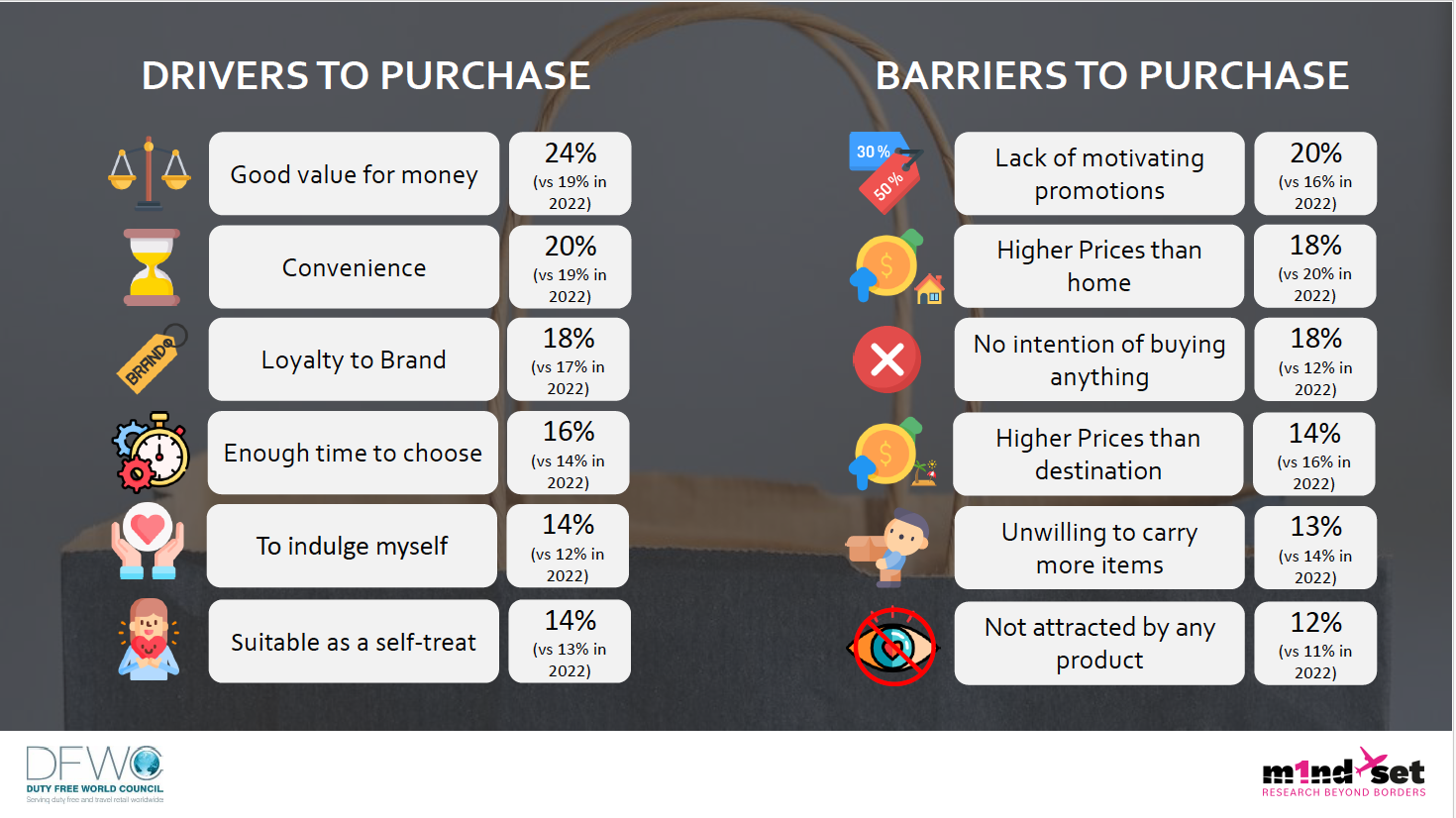

This analysis, which contrasts 2023’s data against 2022’s, showcases the dynamics of customer flow across global regions and highlights key consumer behavior trends, including purchase motivations and barriers to purchase, planning, intent, engagement points, and interactions with in-store personnel. The KPI Monitor, produced by industry research firm m1nd-set, is issued quarterly.

Reduced engagement, increased impulse

The report indicates noticeable shifts in consumer behavior at various points where they obtain information about duty free shopping opportunities, and also their interactions with retail staff in stores.

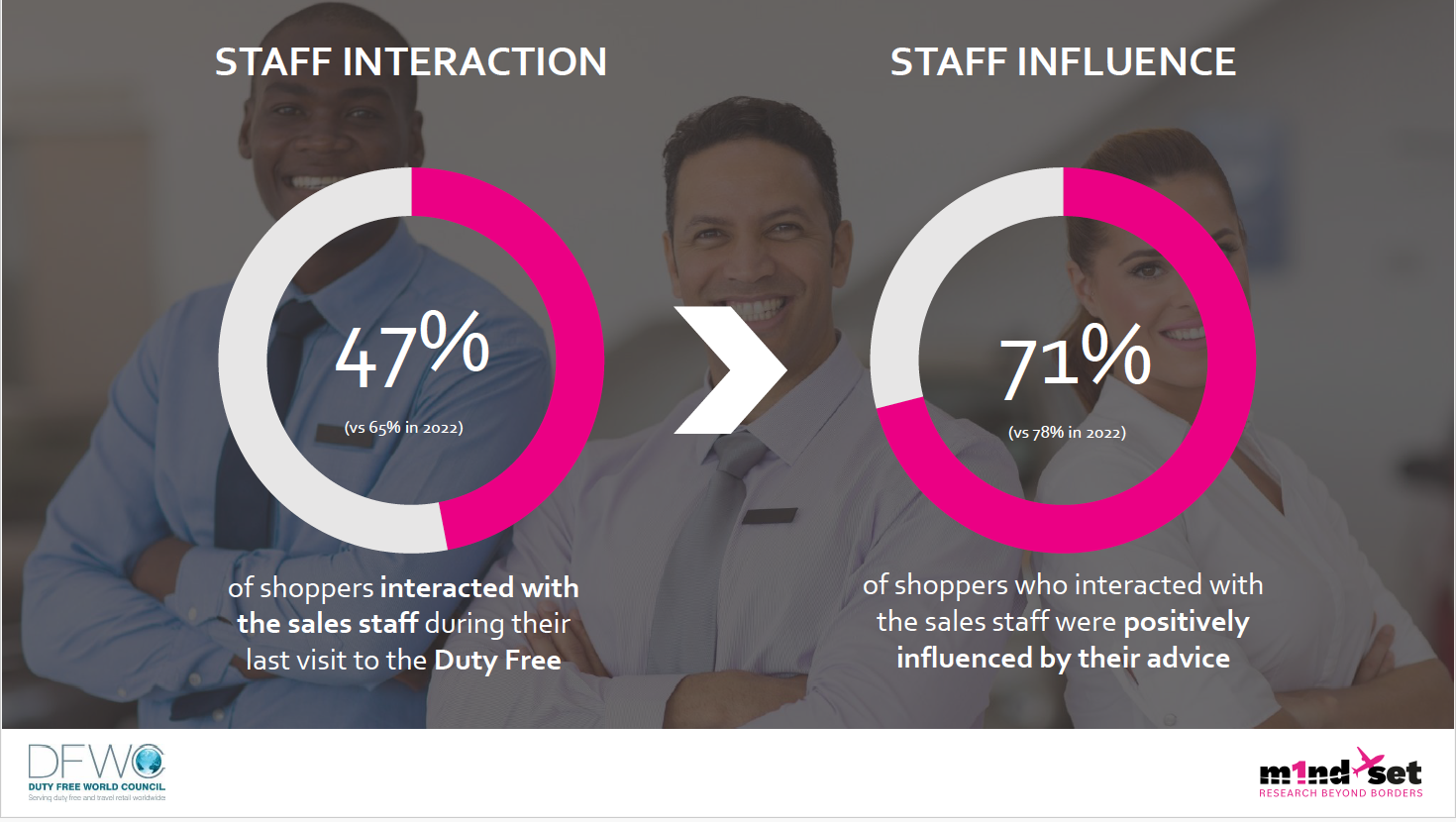

One notable finding is that less than half of global shoppers engaged with sales staff inside duty free stores, a decline from the nearly two-thirds (65%) who did so in 2022. The positive impact of staff interactions on purchasing decisions has also seen a reduction, with 71% of consumers in 2023 reporting a beneficial influence, down from 78% the year before.

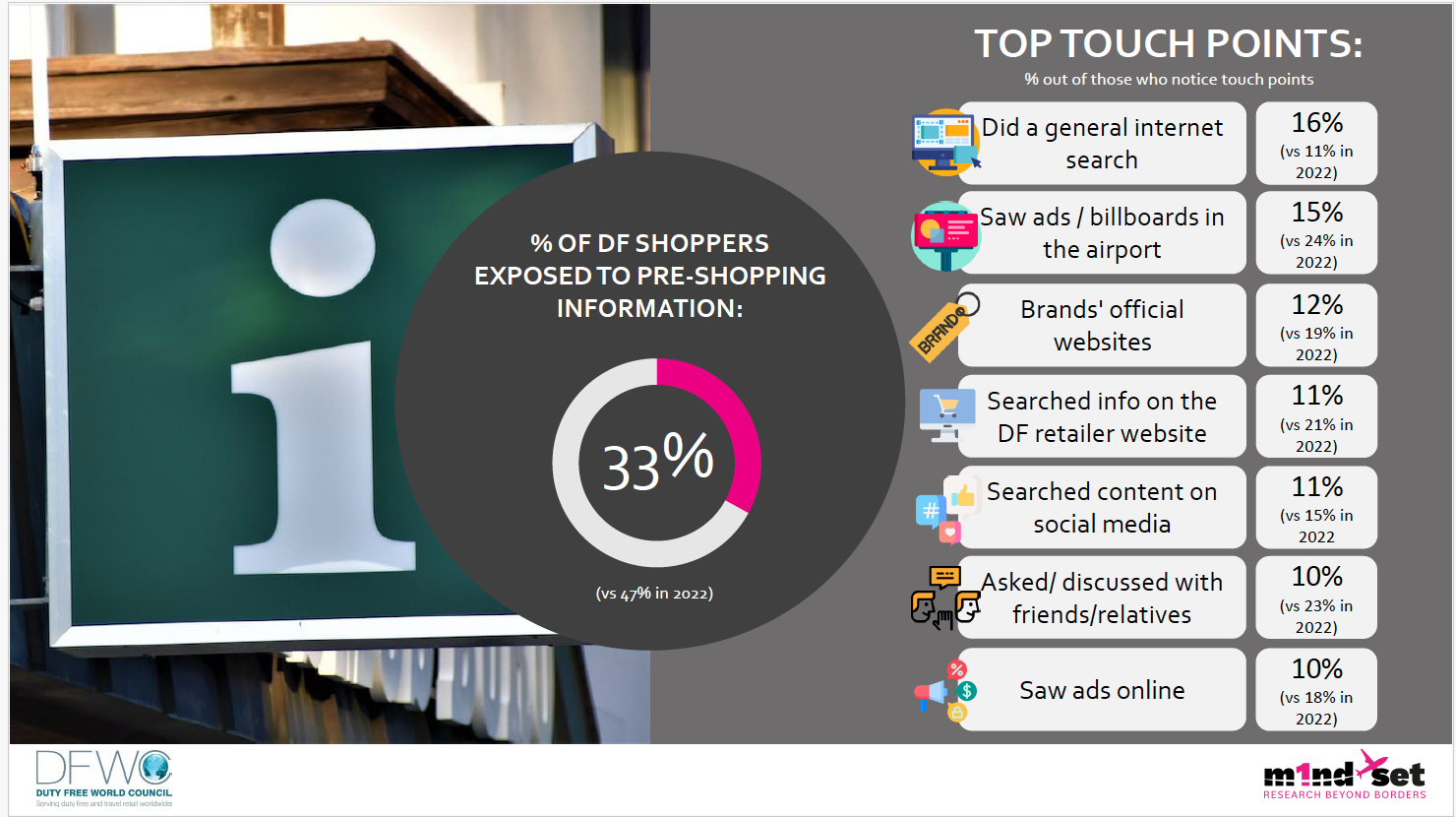

The study further revealed that, at 16%, internet searches emerged as the leading method for seeking information, increased from 11% in 2022. Other sources of information witnessed declines in their influence between 2022 and 2023, including billboard advertising (24% to 15%), brands’ websites (19% to 12%), duty free retailers’ websites (21% to 11%), and online ads (18% to 10%).

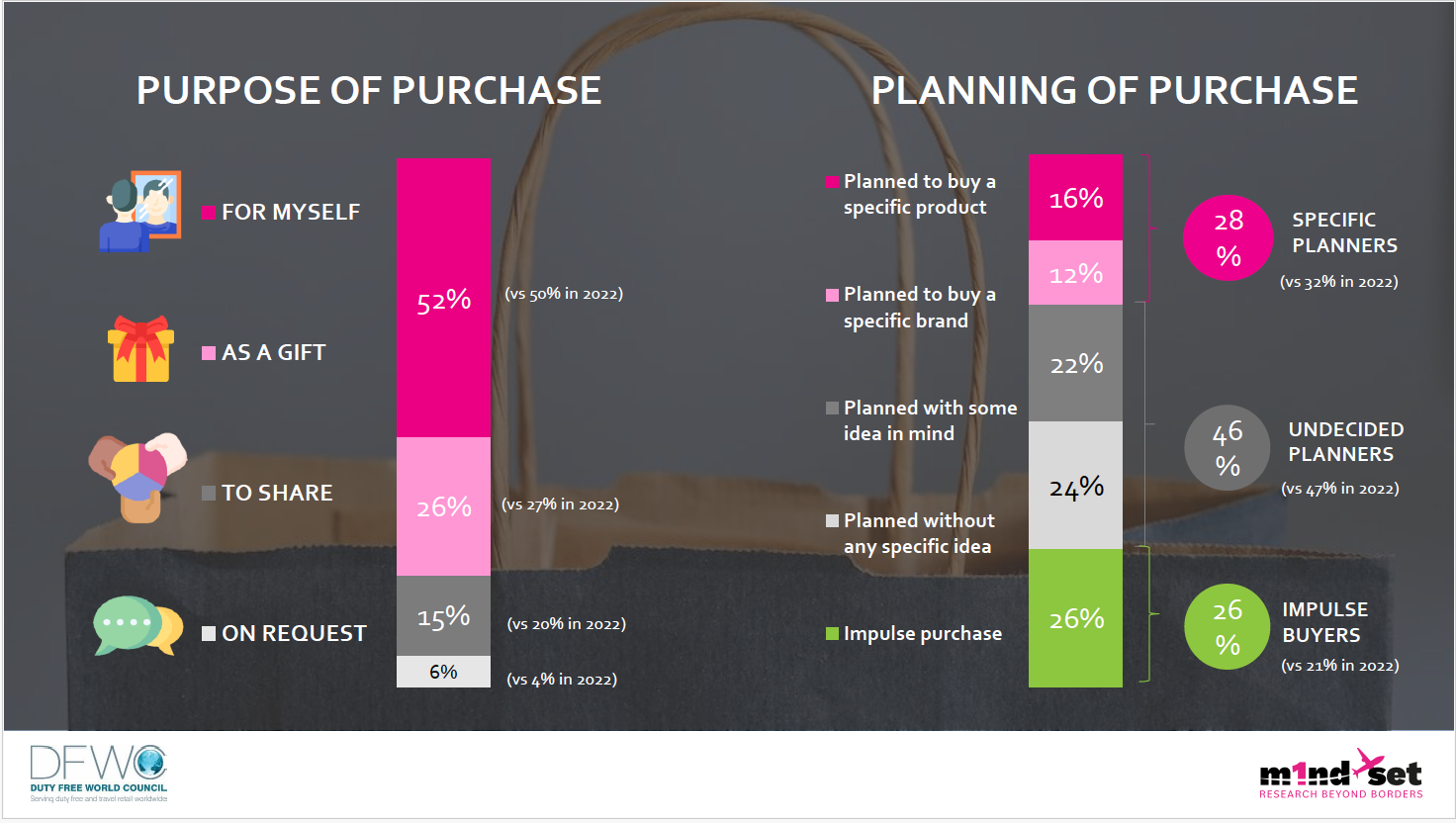

The report also addresses a downward trend in the overall planning of purchases between 2022 and 2023. While in 2022, 79% of shoppers had either specific or vague plans for their duty free purchases while slightly over 20% bought on impulse, the figures for 2023 show a slight decrease in planning and an uptick in impulse shopping, with just under 75% planning their purchases and 26% making impulsive buys.

DFWC President Sarah Branquinho says the industry should reassess how we are communicating with travelers

DFWC President Sarah Branquinho stated, “The quarterly DFWC KPI Monitor is an excellent tool to gauge how shopper behavior is evolving from one season to the next. The full-year analysis enables us to take a step back, assess longer-term trends, and identify opportunities for the industry to adapt to shopper behavior and consider different approaches to consumer marketing strategies.”

Branquinho added, “Only one third of shoppers say they were exposed to touch points in 2023 compared to just less than half of shoppers the previous year which suggests the industry should reassess how we are communicating with travelers and seek to improve on generating awareness about the duty- and tax-free retail offer.”

Peter Mohn, CEO and owner of m1nd-set, said: “The decline in engagement with touch points can be explained by the fact that the pandemic effect has now ended, and that people tend to go back to their pre-Covid behavior; this means they are doing less online research about the travel retail shopping offer. It may also be interpreted by the fact that the shoppers are less excited about traveling compared to immediately after the pandemic. There seems to be a trend towards normalization again.”

International travel trends

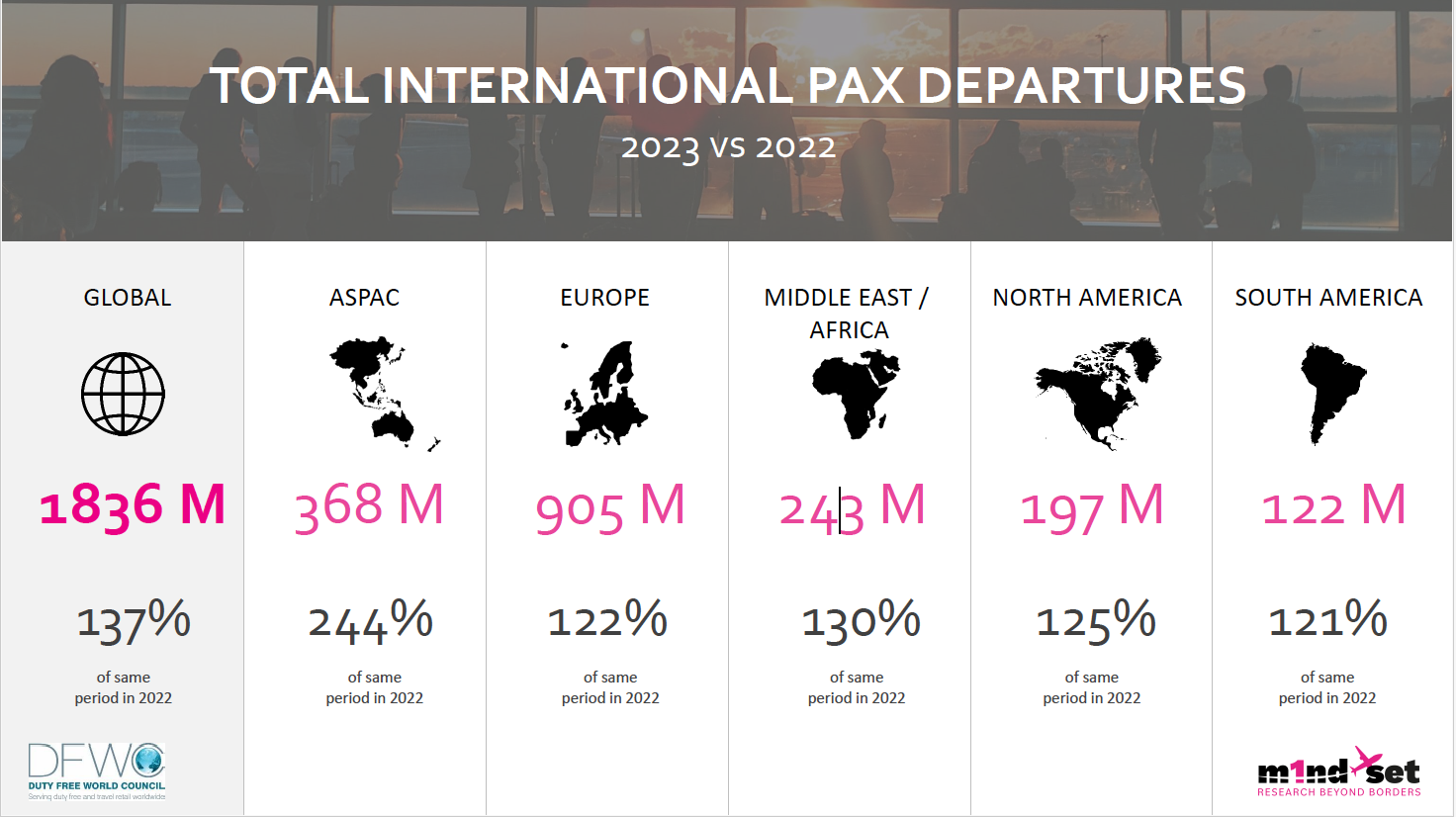

Additionally, the DFWC KPI Monitor examines global air traffic and the rankings of top airports and nationalities for international departures. The Asia Pacific region witnessed the most notable growth in international departures in 2023, buoyed by later border reopenings and the easing of travel restrictions compared to other regions. Air traffic in Asia Pacific surged by 244% over 2022, outpacing the global average increase of 137%.

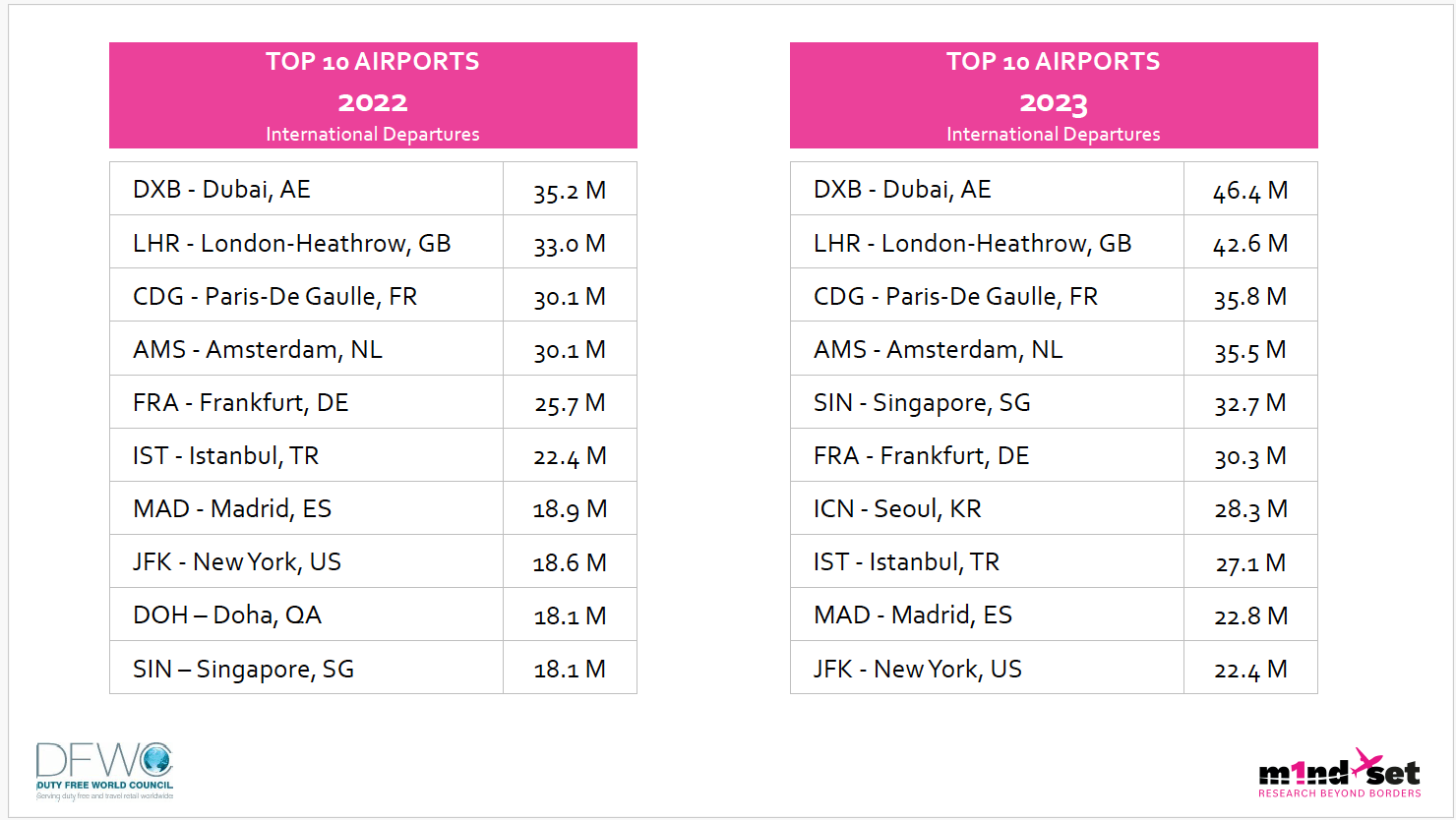

Changes in the top 10 airport rankings between the two years were modest, with Dubai, London Heathrow, Paris Charles De Gaulle and Amsterdam maintaining their leading positions. Singapore rose from tenth to fifth. Seoul Incheon Airport broke into the field in seventh place, while Doha’s Hamad International dropped out of the top 10. Frankfurt, Istanbul, Madrid, and JFK rounded out the list, with slight shifts in position.

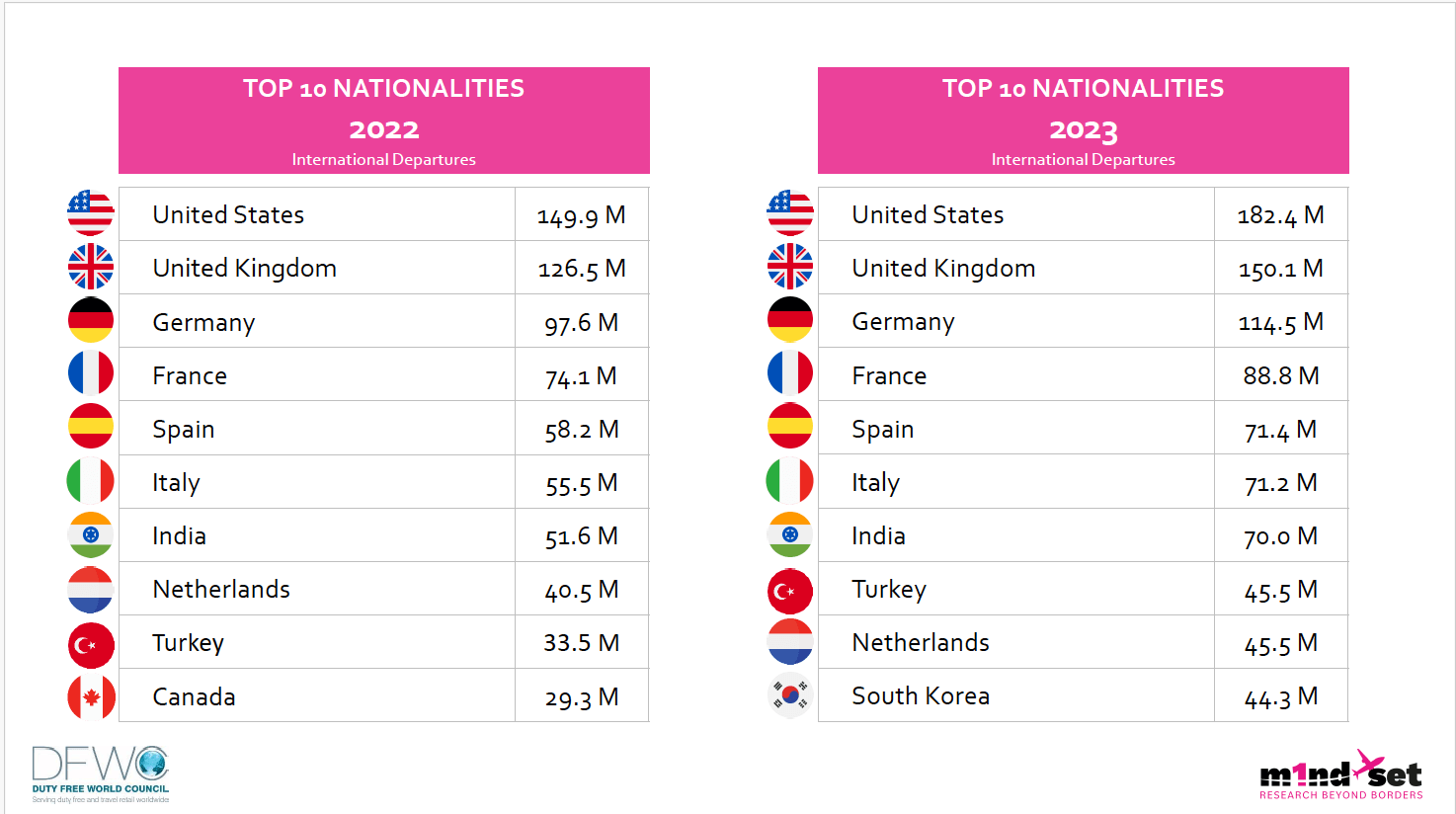

The list of top ten nationalities for international departures remained largely unchanged, with Canada disappearing from the top 10, being replaced by South Korea in 2023.