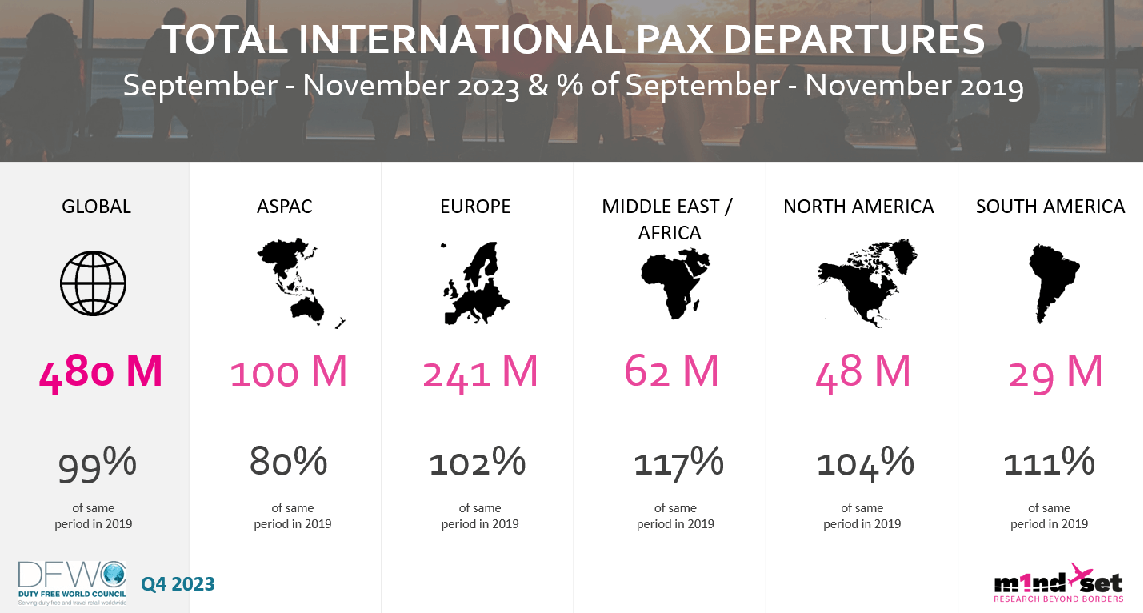

DFWC update: Air traffic surpasses 2019 levels in nearly all regions

The Duty Free World Council (DFWC) has released its quarterly air traffic and shopper behavior monitor, revealing that Asia Pacific is the only region where air traffic in the last quarter remained below pre-pandemic 2019 levels.

The Middle East and Africa region shows the strongest recovery following the pandemic, at 117% of 2019 levels, according to the DFWC KPI Monitor, prepared for the Council by Swiss research agency m1nd-set. South America is in second position with 111% of 2019 levels, North America follows with 104%, then Europe with 102%.

The latest report details changes in total international pax departures

In Asia Pacific, where the recovery was delayed by staggered re-openings, air traffic stands at 80% of 2019 levels, according to m1nd-set’s B1S tool, which sources air traffic and forecast data from IATA’s comprehensive DDS database. The weaker performance in Asia Pacific brings the global average to just below 100% for the fourth quarter of 2023, at 99% compared to the global average for the same period in 2019.

There is little movement in the top nationalities for international departures between Q3 and Q4 2023. The US, the UK, Germany, and France remain the top four countries for departing nationalities, with Spain replacing Italy in fifth position. Italy fell from fifth to seventh place while India moved up from seventh position in Q3 2023 to sixth position in Q4. Turkey and the Netherlands follow, and South Korea moves into the top ten rankings for international departing nationalities, replacing China, which occupied tenth position in Q3.

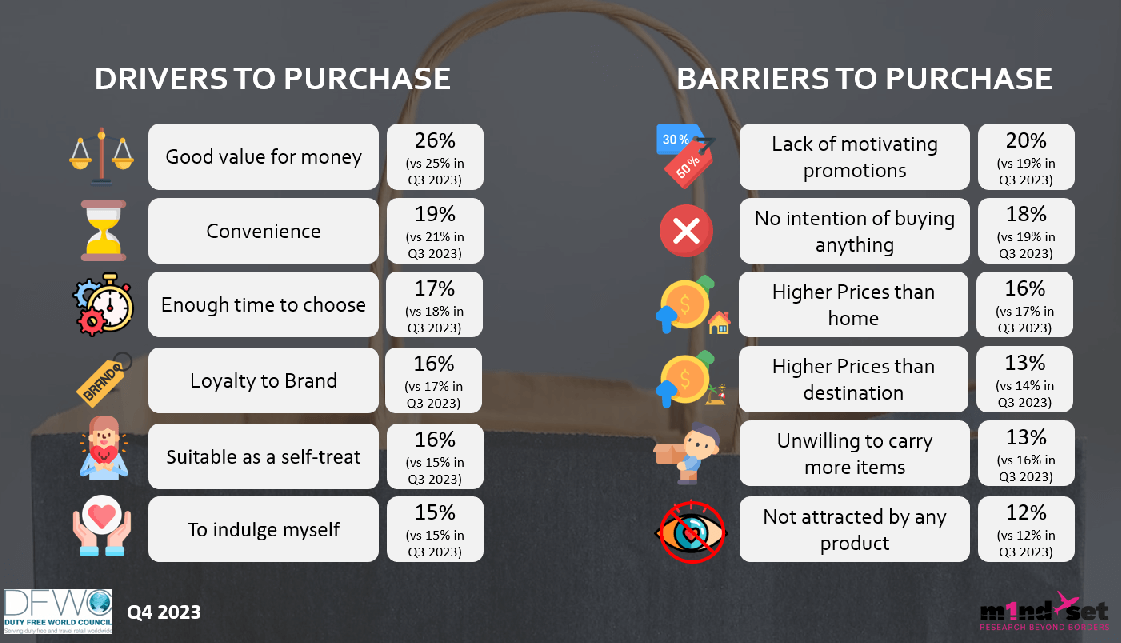

The DFWC update also features drivers and barriers to purchase

According to the quarterly monitor, which also analyses evolutions in shopper behavior from quarter to quarter, purchase planning behavior has seen quite considerable movement between Q3 and Q4. 73% of shoppers globally planned their purchases in Q4 to some extent, either specifically or with some idea of what they had in mind. This is seven points higher than in Q3, 2023.

Peter Mohn, CEO and Owner of m1nd-set, commented, “It is not unusual to see higher levels of shopping planning during the pre-festive period seasons. However, we see that as consumers have returned to the skies in greater numbers and are enjoying the travel experience and emotions that are generated by increasingly more inspiring airports and airport retail, that this is also having an impact on the tendency to plan airport shopping. We see that the purchase motivation has evolved also, particularly when comparing to the same period in 2022. Self-purchases have declined by 5% over the period. Purchases for sharing have also declined, while gift purchases and purchases made on request of friends and family have both increased between Q4, 2022 and the same period in 2023.”

Commenting on the Monitor findings, DFWC President Sarah Branquinho, added: “Industry training programs on customer service and engagement appear to be producing positive results, as staff interaction levels are on the rise once again after consistent declines over previous quarters. The latest Monitor reveals that in Q4, 47% of shoppers globally interacted with sales staff, an increase of 3% on Q3 last year. The impact of staff interactions also rose moderately, from 68% in Q3 to 69% in Q4..

“We are still a long way from early post-pandemic engagement levels, however, which were at over 70%, with impact levels higher still. The importance of quality training on staff interaction for improved customer engagement and the delivery of a world class customer experience, whether through the DFWC Academy or individual company staff training programs, cannot be highlighted enough,” she concluded.