Young generations show high potential for cruise retail development, finds m1nd-set

The analysis identifies certain noteworthy differences and outlier behavior among younger travelers

Swiss travel and travel retail research agency m1nd-set’s 2023 research on the cruise sector highlights travel and shopping trends among young travelers, pointing to a positive outlook for cruise retail over the coming years.

The research sets out to answer several key questions about shopper behavior on cruise ships, including which are the major source markets and destinations, who is shopping on cruises, why and what for, what motivates cruise travelers to visit the shops while on a cruise, what do they purchase, and how can stakeholders best reach out to cruise shoppers prior to purchase?

The analysis identifies certain noteworthy differences and outlier behavior among younger generations. Cruise retail is set to benefit significantly if these differences are taken into account, according to m1nd-set.

‘Younger travelers’, defined as the Millennials and the older bracket of the GenZ travelers (25+), are demonstrating they represent enormous potential for the growth of the cruise and cruise retail sector, the research outlines, both in terms of their desire to holiday on cruise ships and their shopping behavior on board. 88% of Millennials who have taken a cruise vacation already plan to go on a cruise again. GenZs are less enthusiastic about repeating the holiday experience, but the number of repeat cruise vacationers is still strong at 78% among this generation.

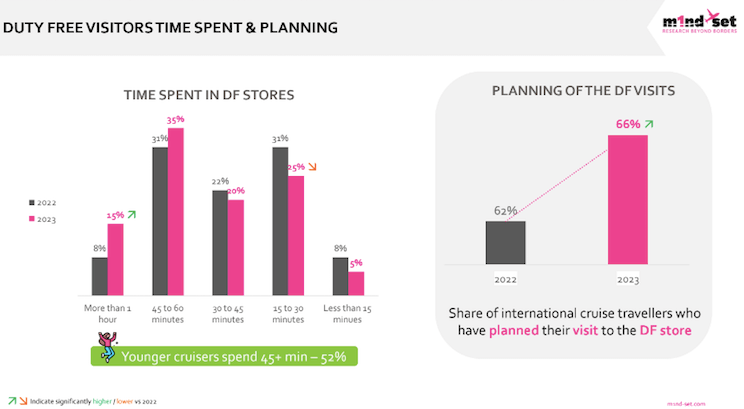

m1nd-set chart: Duty free visitors time spent and planning

m1nd-set chart: Duty free visitors time spent and planning

m1nd-set owner and CEO Dr. Peter Mohn said, “The potential young travelers present to the cruise sector is particularly evident for cruise retail – both in the present and future – when we study their shopping behavior. Firstly, we see that younger generations visit the shops more frequently during a cruise trip than other generations. The average number of shop visits during the cruise increased to 3.2 this year but younger generations made 3.6 visits to the shops during the cruise journey. They also spend more time in the shops – 52% of younger travelers spent more than 45 minutes in the shop compared to the average of 35%.”

Younger travelers also plan their purchases more than the average traveler, according to the research. 94% of younger travelers plan their purchases compared to the average across all age groups of 88%. The research highlights how younger generations demonstrate outlier behavior in particular through their category purchases, in comparison to all age groups. 60% of younger shoppers said they purchased Perfumes this year, compared to an average of 43%. Similar differences are seen for Food and Confectionery purchases and Souvenirs and Gift items. 28% of all shoppers purchased Food & Confectionery in 2023, compared to 39% among younger shoppers, while 20% of younger cruisers purchased Souvenirs and Gift items compared to the average of 13%.

Engagement is also higher among younger travelers, whether with staff or communications touch points in general. 73% of all cruise shoppers said they noticed touch points before shopping, but this is even greater among younger shoppers, 80% of whom noticed communications touch points before shopping. They are also more likely to take note of the promotions in the cruise retail space; 45% noticed a promotion compared to 39% among all shoppers.

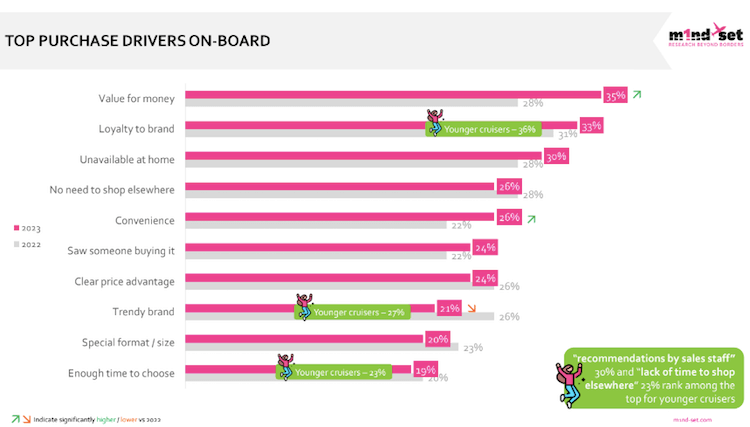

m1nd-set chart: Top purchase drivers on-board

m1nd-set chart: Top purchase drivers on-board

Staff interaction for the younger generations is also more common and more impactful among younger generations on cruise ships. 88% of younger travelers say they interacted with the staff, compared to 81% of cruise shoppers across all age groups. 93% of younger travelers say their purchase was influenced by the interaction with the staff compared to 83% across all age groups. Younger shoppers place great importance on testing, trying and touching the products; 82% said they tried and tested products prior to purchase compared to 73% among all cruise shoppers.

“The research clearly demonstrates the quite unique behavior of younger travelers," continued Mohn. "Not only are Millennials and Gen Zs growing in size in terms of their share of the traveling population, they are also spending more time and money inside the stores and more likely to see all pre-travel and pre-shopping information than older generations.

“Their behavior in terms of media consumption is also quite different to their parents and grandparents, particularly for Gen Zs. Much can be gained from deeper study of these highly important and high-potential shopper segments. As Millennials and Gen Zs age they will continue to dominate the focus of travel retail insights and marketing managers, and rightly so.”