m1nd-set forecasts optimistic outlook for Asia Pacific travel

The Asia Pacific region is set for a strong revival, according to the latest research by travel and travel retail research agency m1nd-set.

According to the company, "The research unveils the outlook for traffic in the next two to three years, highlighting both the hot spots and the destinations that are experiencing a slower return to pre-pandemic levels. It also looks at shopper behavior, revealing how consumers across the region are shopping differently in travel retail comparing pre-pandemic behavior to the trend in 2022."

Among the most encouraging findings in the research is the promising outlook for the region in terms of traffic growth in the immediate future.

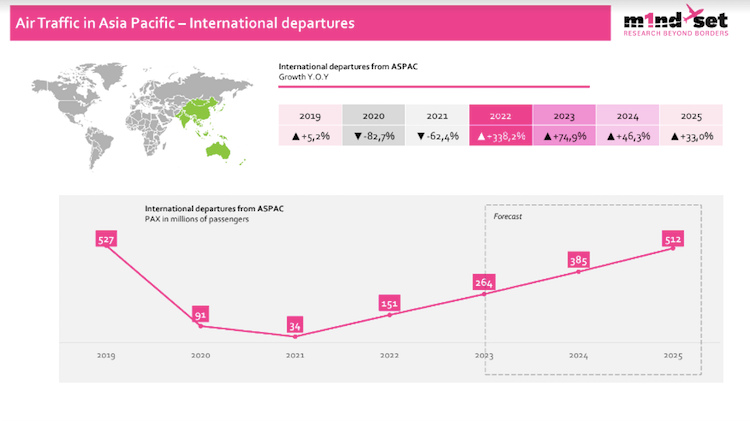

“The revival across the region is looking extremely positive as total air traffic globally rose by 140% year-on-year in 2022, while in Asia Pacific, air traffic grew by nearly 340% year-on-year, reaching 150 million passengers," said m1nd-set owner and CEO, Dr. Peter Mohn. "This is still a long way off pre-pandemic traffic levels however, Asia Pacific will not reach pre-pandemic levels until 2025 when traffic will surpass 500 million once again. Over the next three years however, we will continue to see well above-average year-on-year growth in international departures. Asia Pacific will post 75% growth in 2023, compared to the global average of 22%, 46% in 2024 vs 16% globally and 33% in 2025, compared to 13.5% globally.”

The research also highlights those airports that will surpass the pre-pandemic levels first in 2024, namely Tokyo Narita and Tokyo Haneda in Japan, which will see international departures surpass the 2019 levels by 16% and 27% respectively; Sydney and Melbourne in Australia, where traffic will surpass 2019 levels by 6% and 5% respectively; and Mumbai, where international traffic will surpass 2019 traffic by 1% in 2024.

The main destinations for Asia Pacific travelers are also cited in the latest m1nd-set research, based on actual traffic throughout 2022. The majority (13) of the top 20 destinations are intra-regional and mainly Singapore, Bangkok and Seoul. Seven of the top 20 destinations from Asia Pacific in 2022 were outside the region, mainly to neighboring Middle East airports, including Dubai, Jeddah, Riyadh, Sharjah and Doha, but also to London Heathrow and Los Angeles.

The shopper behavior in the post-pandemic travel retail environment across the region, based on travel undertaken in 2022 also spurs hope of a positive revival in GTR revenues, but there are mixed results. Shoppers are spending significantly more than they did in 2021, and marginally more than the 2019 spend. The m1nd-set research reveals that average spend per passenger among Asia Pacific Duty Free shoppers in 2022 was $195, an increase of around 5% on the 2019 spend level of $186 and an increase of 38% on the 2021 spend level of $141 in 2021.

m1nd-set’s analysis of footfall and conversion rates in 2022 paint a somewhat less rosy picture. Footfall has declined when comparing to the 2019 level of 50% but has risen slightly compared to 2021 from 36% to 41% in 2022. Conversion levels are not looking as positive, as only 54% of shop visitors purchased from the Duty Free shops in 2022, 17% lower than the percentage in 2019 and 14% lower than in 2021.

Food and Confectionery was the most purchased category in 2022, according to the m1nd-set research, with 30% of shoppers purchasing the category, up from 26% and second place in 2019; Perfumes was the second most purchased category with 25%, five percent more than in 2019. Alcohol, that wasn’t previous listed among the top five categories purchased among Asia Pacific shoppers in GTR in 2019, was the third most purchased category in 2022 with 17% of shoppers from the region purchasing wines and spirits. Tobacco and Skincare moved from third and fourth position to fourth and fifth position in the rankings with 16% and 14% of shoppers respectively purchasing the categories in 2022.

Other interesting evolutions in Asia Pacific shopper behavior, according to m1nd-set, include the shopping planning behavior. The number of shoppers who plan a specific product or brand purchase has increased from 25% in 2019 to 41% in 2022. Staff interaction is another area: Asia Pacific shoppers tend to interact with sales staff much more than before as only 52% of shoppers from the region interacted with sales staff to seek advice or information prior to the pandemic. This increased to 80% immediately after the pandemic in 2021 and although lower in 2022 at 70%, there is still a much greater window of opportunity to engage with potential shoppers and convert browsers into buyers.

Underlining the importance of staff interaction, Mohn added, ”It’s imperative that sales staff are informed of the influence they wield so they understand the importance of proactively engaging with passengers. The influence which the sales staff have on the purchase decision making process has increased significantly since the pandemic.

“Only just over half of the interactions (54%) influenced the decision to purchase in 2019, whereas more than three quarters (76%) of interactions produced positive results in 2022. It’s not only important for sales associates to have firm product knowledge about the products they are selling but also about whom they are selling to.”