APAC traffic to reach pre-pandemic levels by 2026, shows new m1nd-set forecast

m1nd-set has released its air traffic forecast for 2023 which includes a four-year forecast up until 2026

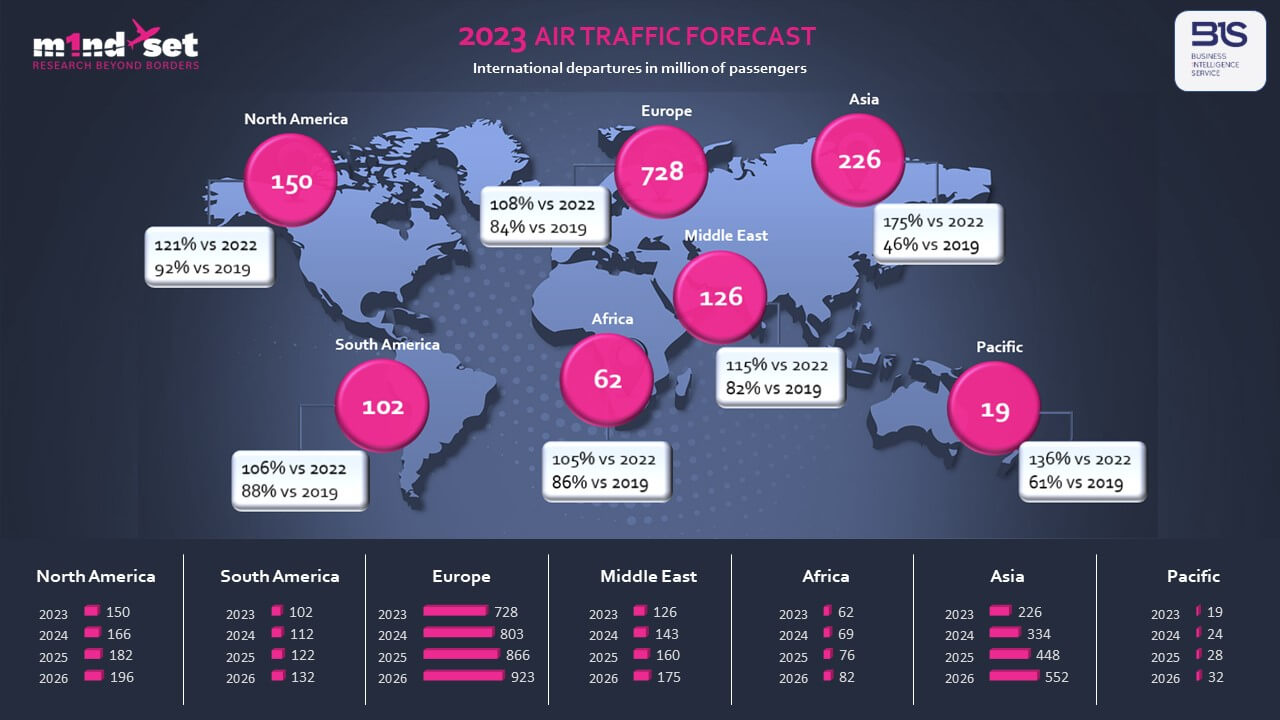

m1nd-set has released its air traffic forecast for 2023 which includes a four-year forecast up until 2026. Asia and the Pacific will see the largest year percentage gains in air traffic in 2023, according to the Swiss research agency.

The m1nd-set traffic forecast is compiled via the agency’s data tool, B1S, in partnership with IATA and their air traffic data partner ARC, which comprises the world’s most comprehensive traffic and traffic forecast database.

m1nd-set reports Asia will see a 75% increase in traffic this year vs. 2022, reaching 226 million passengers, an increase which represents only 46% of the pre-pandemic traffic levels in 2019. The Pacific region will see the second largest year-on-year traffic increase, reaching 19 million passengers this year, which represents 61% of 2019 levels. This is up 36% compared to 2022. It’s expected that traffic across Asia Pacific will reach pre-pandemic levels by 2026.

In Asia, international departures will surpass 2019 traffic in 2026 with 552 million passengers, growing from 334 million in 2024 and 448 million passengers in 2025. Asia will see the highest compound annual growth rate (CAGR) between 2023 and 2026 of 36%. In the Pacific region, air traffic will see a CAGR from 2023 to 2026 of 17%, growing from 19 million passengers this year, to 24 million in 2024, 28 million in 2025 and surpass 2019 levels with 32 million international passengers by 2026.

Listed third in terms of largest growth percentage is North America in 2023, reaching 150 million passengers, which represents 121% of the 2022 level and is nearing the pre-pandemic level at 92% of 2019 traffic. Traffic in North America between 2023 and 2026 will see a CAGR of more than 7.5%. Traffic will surpass the pre-pandemic levels in North America by 2024, when international departures will reach 166 million. By 2025, traffic in North America will reach 182 million and 196 million by 2026.

The Middle East will see international air traffic increase by 15% in 2023 to reach 126 million, which is 82% of the 2019 level. The CAGR in the Middle East will fall just short of 10%, but the region will not see traffic surpass the pre-pandemic levels until 2025, by which time international traffic will have reached 160 million, up from 143 million in 2024. In 2026, traffic in the Middle East will reach 175 million international departures.

Europe represents the largest world region for international air traffic with 728 million international departures forecast for 2023, up 8% on 2022 levels and 84% of the 2019 traffic numbers. Europe will also reach pre-pandemic traffic levels in 2025, when traffic will reach 866 million, up from 803 million in 2024. European air traffic will experience a compound annual growth rate of circa 6.5% between 2023 and 2026 when traffic will reach 923 million international departures.

International air traffic in South America will reach 106% of the 2022 level to reach 102 million passengers, which is 88% of 2019 traffic which was circa 115 million. In 2024, traffic will fall just short of the pre-pandemic 2019 level in South America at 112 million passengers, growing to 122 million in 2025 and 132 million in 2026, posting a CAGR of circa 7.4%.

Traffic across the African continent will see the least robust growth in 2023, with traffic reaching only 105% of 2022 levels at 62 million, around 86% of the pre-pandemic level. The region will see a CAGR of circa 8% 2023 and 2026, reaching 69 million in 2024, surpassing the 2019 level in 2025 with 76 million and 82 million international passengers in 2026.

“The B1S traffic forecasts in partnership with IATA and DDS are the most accurate in the industry given that they consider airline flight and reservation data, including data direct and indirect sales data, from around 500 airlines, as well as GDS data from all relevant booking platforms. Most other traffic forecasts only use the GDS data which represents less than half the overall data. The B1S IATA data also considers other external factors such as macro-economic and geopolitical events that can impact international travel.

“When combining this accurate traffic data with our own shopper insights, compiled from hundreds of airports across the globe, we can provide our industry partners with the most realistic projection of shopper behavior by region, market and even airport for the next two to three years. This also incorporates what shoppers are saying about how they will change behavior in the future, based on changing priorities and concerns” says Dr. Peter Mohn, Owner & CEO at m1nd-set.

The return of the Chinese traveler: SH 2023

Referring to the return of the Chinese traveler segment, Mohn explains that it will take place gradually.

“We realize that the industry is eagerly awaiting the return of Chinese travelers but we need to be realistic about this. At m1nd-set we project that the Chinese will not be traveling in large numbers until the second half of the year. This is due to several factors. Firstly, many passports have expired and will take quite some time to get the renewals processed, due to high demand. Secondly, there will be inevitable delays in visa processing given the reduced staff numbers in foreign consulates.

“Also, following the ban of group tour package sales in China early in the pandemic, initially we will see only independent and already experienced travelers returning. Another reason the return of the Chinese will not be an overnight occurrence is that all the leading airlines will need time to resume the flights. Price will also be a barrier to a sudden spike in numbers; flying has become less affordable for many Chinese as prices have increased significantly compared to before the pandemic,” he concludes.