Recovery set back by Omicron, Russia-Ukraine conflict

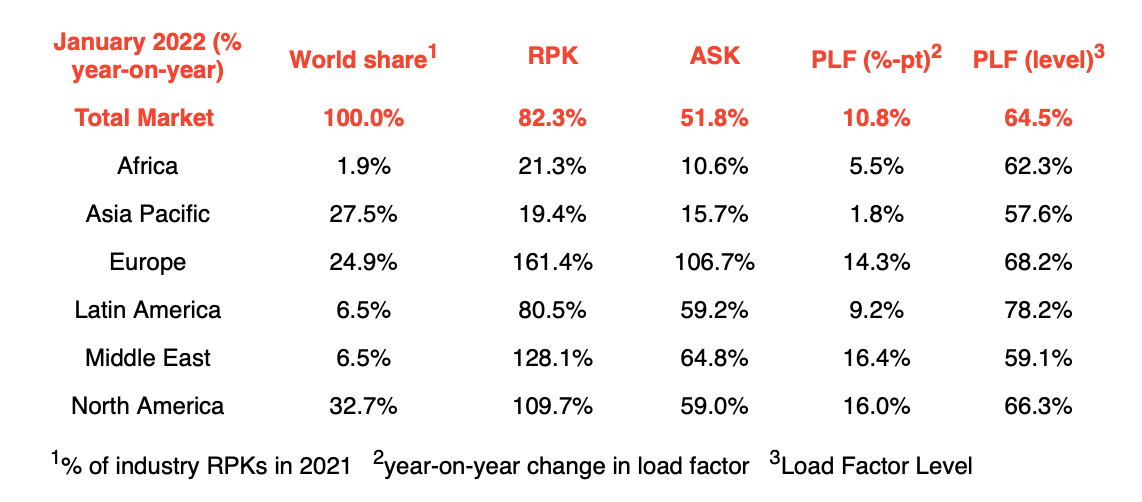

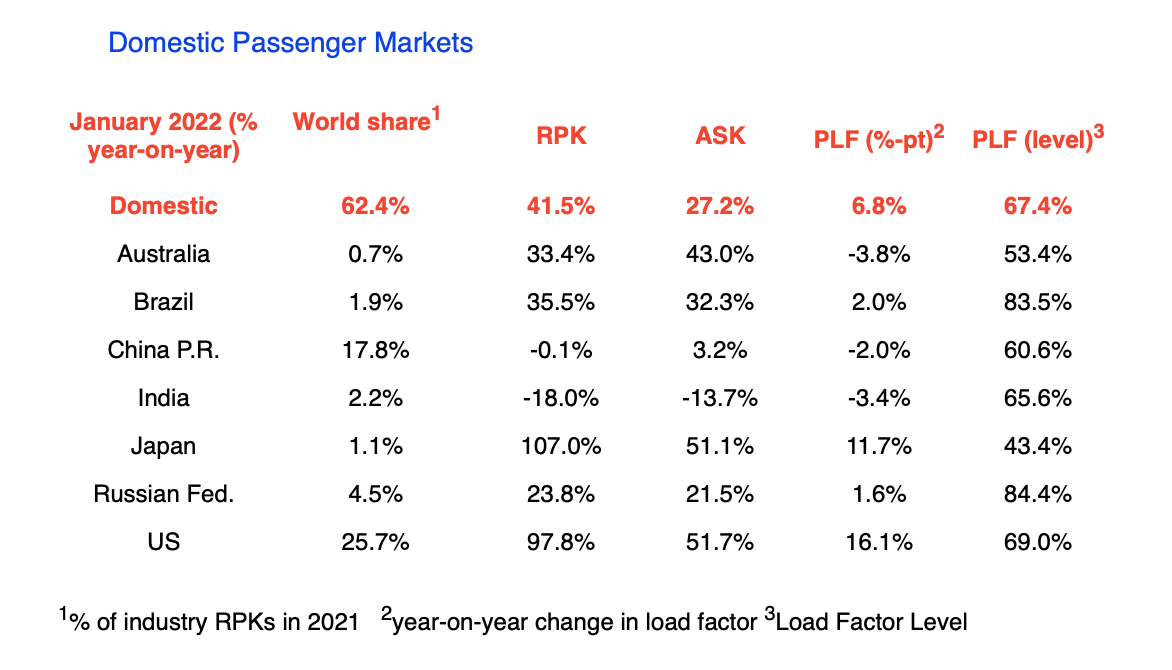

The International Air Transport Association (IATA) has released domestic and international travel figures for January 2022, now once again comparing year on year rather than comparing to 2019. Because of this, some comparative figures might appear high while they are still low relative to 2019.

The recovery slowed in January relative to December 2021, due to renewed travel restrictions following the rise of the Omicron variant.

Total travel in January 2022 was up 82.3% over January 2021, but down 4.9% vs December 2021 on a seasonally adjusted basis.

Domestic travel was up 41.5% in January YOY, but fell 7.2% vs December 2021, seasonally adjusted.

Internationally, RPKs increased 165.6% versus January 2021, but adjusted figures showed a fall of 2.2% from December.

“The recovery in air travel continued in January, despite hitting a speed bump called Omicron. Strengthened border controls did not stop the spread of the variant. But where population immunity was strong, the public health systems were not overwhelmed. Many governments are now adjusting COVID-19 polices to align with those for other endemic viruses. This includes lifting travel restrictions that have had such a devastating impact on lives, economies and the freedom to travel,” said Willie Walsh, IATA’s Director General.

International Passenger Markets

European international traffic rose 225.1% in January 2022 versus January 2021. Capacity rose 129.9% and load factor climbed 19.4 percentage points to 66.4%.

• Asia-Pacific international traffic climbed 124.4% compared to January 2021, but remains extremely low compared to pre-pandemic. Capacity rose 54.4% and the load factor was up 14.7 percentage points to 47.0%, still the lowest among regions.

• Middle Eastern airlines saw 145.0% increase in January 2022 vs January 2021, significantly down compared to the 178.2% increase in December 2021, versus the same month in 2020. Capacity was 71.7% higher than January 2021, and load factor climbed 17.5 percentage points to 58.6%.

In North America, international travel increased 148.8% versus January 2021, but this was significantly down compared to the 185.4% rise in December 2021 compared to December 2020. Capacity rose 78.0%, and load factor climbed 17.0 percentage points to 59.9%.

• Latin American airlines saw a 157.0% rise in January traffic compared to the same month in 2021. Capacity rose 91.2% and load factor increased 19.4 percentage points to 75.7% — the highest load factor for 16th consecutive month.

• African airlines’ traffic rose 17.9% in January 2022 versus a year ago, a slowdown compared to the 26.3% year-over-year increase recorded in December 2021. January 2022 capacity was up 6.3% and load factor climbed 6.0 percentage points to 60.5%.

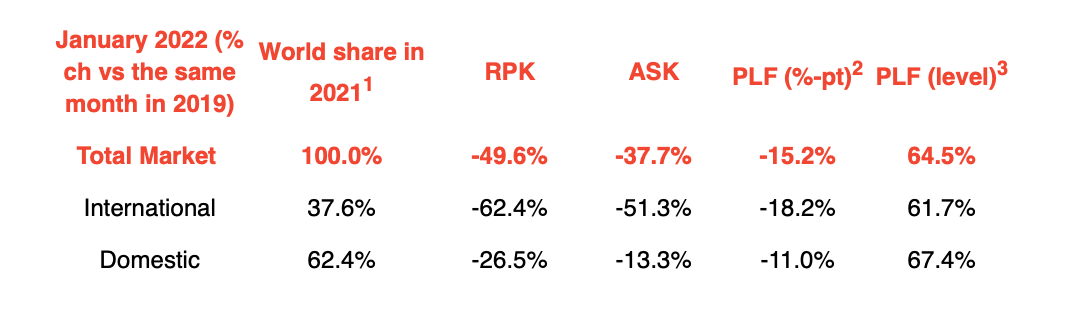

Despite the strong traffic growth recorded in January 2022 compared to a year ago, passenger demand remains far below pre-COVID-19 levels. Total RPKs in January were down 49.6% compared to January 2019. International traffic was down 62.4%, with domestic traffic off by 26.5%.

Russia-Ukraine Conflict

Since these figures were gathered, the Russia-Ukraine conflict which began at the end of February. Resultant sanctions and airspace closures are having a negative effect on travel as expected.

First, Ukrainian and Russian passengers normally account for a small but significant proportion of international travelers. But also, airspace closures have led to cancelations and rerouting of flights at a time when the industry is already depressed. Additionally, fuel prices have increased dramatically.

“When we made our most recent industry financial forecast last autumn, we expected the airline industry to lose $11.6 billion in 2022 with jet fuel at $78/barrel and fuel accounting for 20% of costs. As of 4 March, jet fuel is trading at over $140/barrel. Absorbing such a massive hit on costs just as the industry is struggling to cut losses as it emerges from the two-year COVID-19 crisis is a huge challenge. If the jet fuel price stays that high, then over time, it is reasonable to expect that it will be reflected in airline yields,” said Walsh.

The Bottom Line

“The past few weeks have seen a dramatic shift by many governments around the world to ease or remove COVID-19-related travel restrictions and requirements as the disease enters its endemic phase. It’s vital that this process continue and even accelerate, to more quickly restore damaged global supply chains and enable people to resume their lives. One step to encourage a return to normality is to remove mask mandates for air travel. It makes no sense to continue to require masks on airplanes when they are no longer being required in shopping malls, theatres or offices. Aircraft are equipped with highly sophisticated hospital quality filtration systems and have much higher air flow and air exchange rates than most other indoor environments where mask mandates already have been removed,” said Walsh.