E-commerce develops for the alcohol market as lockdowns restrict both on-trade and store shopping

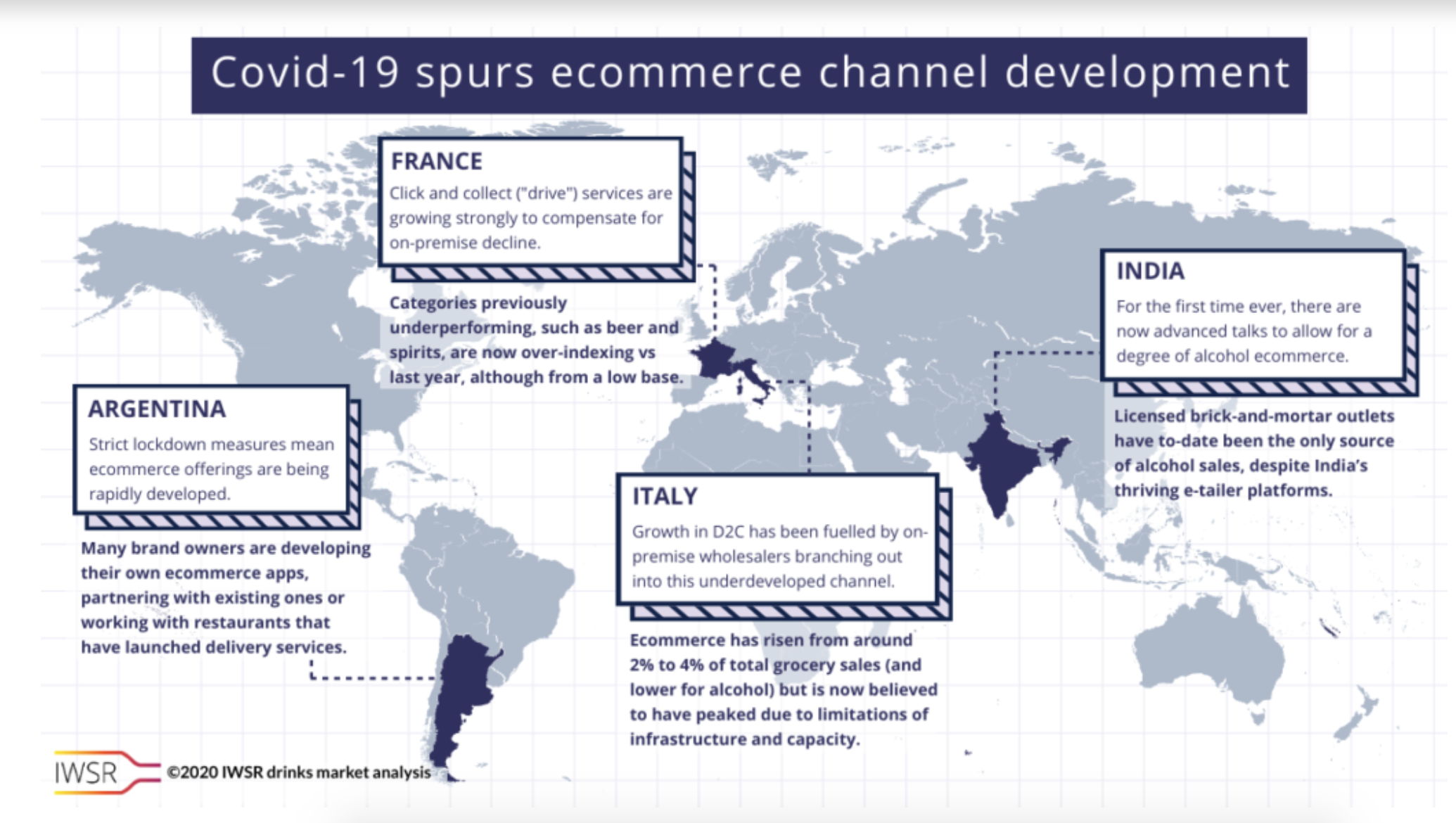

According to IWSR Drinks Market Analysis, the COVID-19 pandemic and subsequent lockdown has spurred e-commerce development in some markets, and looking at how cautious consumers are in countries that are reopening, further development of e-commerce looks to be warranted.

The latest report by IWSR shows that in countries where e-commerce channels for alcohol sales were underdeveloped, the lockdown has encouraged investment in this channel.

In countries with already existing e-commerce structure, such as France, sales in the channel are outperforming that of last year, though we are cautioned to recognize that on-trade and brick-and-mortar retail are currently nonexistent in the one case and difficult to access as usual in the other.

While India has had no alcohol e-commerce, talks are now in advanced stages to change that; this might help provide tax income for Indian states while helping to prevent overcrowding, which has been a problem for currently licensed shops.

Although many governments are now beginning to gradually reopen shops and ease restrictions, evidence shows that customers are still showing some hesitation to return to pre-crisis behavior. Concerns about virus transmission have not abated, and having become accustomed to home-delivery services, consumers are likely to continue using them to some degree.

Regardless of the extent to which these services will be used in future, their importance to brands has not been unnoticed, and will likely continue to be developed as the post-shutdown world moves forward.

.jpg?&resize.width=322&resize.height=483)