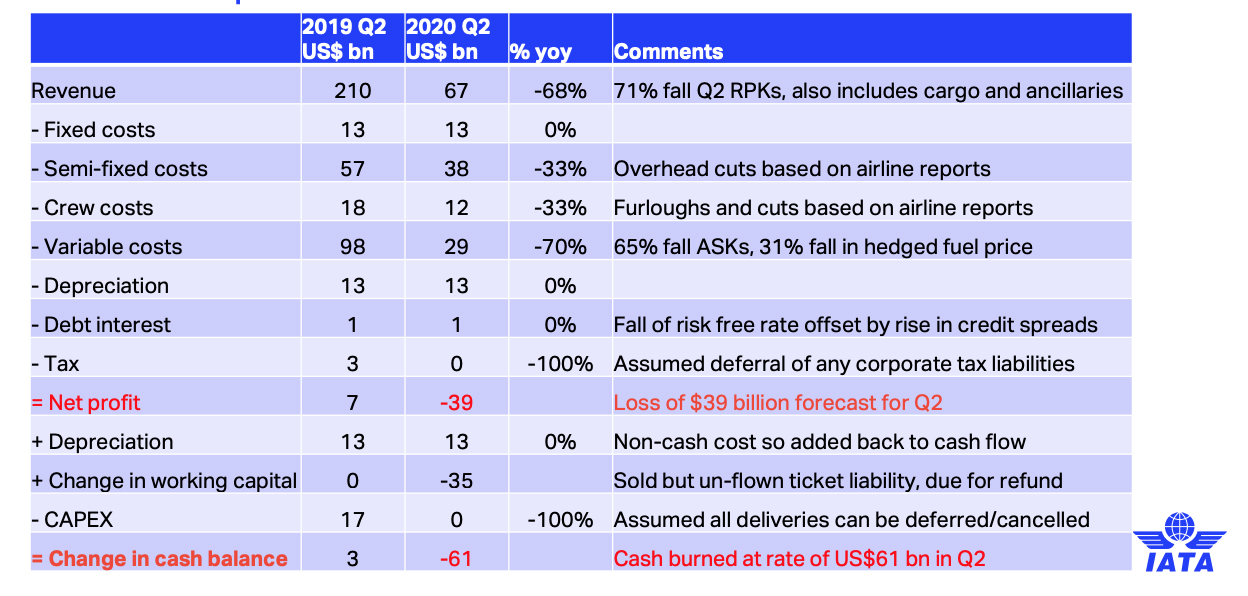

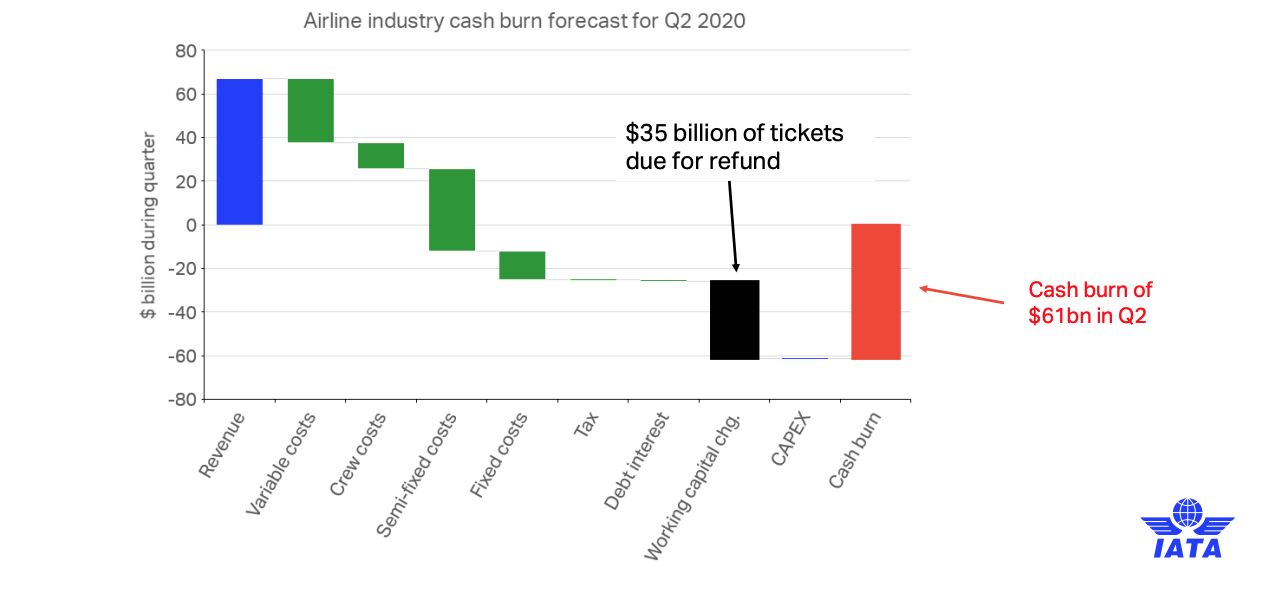

Airlines expected to burn through US$61 billion in Q2 2020

New analysis by the International Air Transport Association (IATA) shows that the second quarter of 2020 will bring about a severe cash burn for global airlines.

The airline industry is expected to post a quarterly loss of US$39 billion while burning through cash reserves of US$61 billion.

Airlines may burn cash at rate of $61 billion in Q2 based on impact assessment released on 24th March

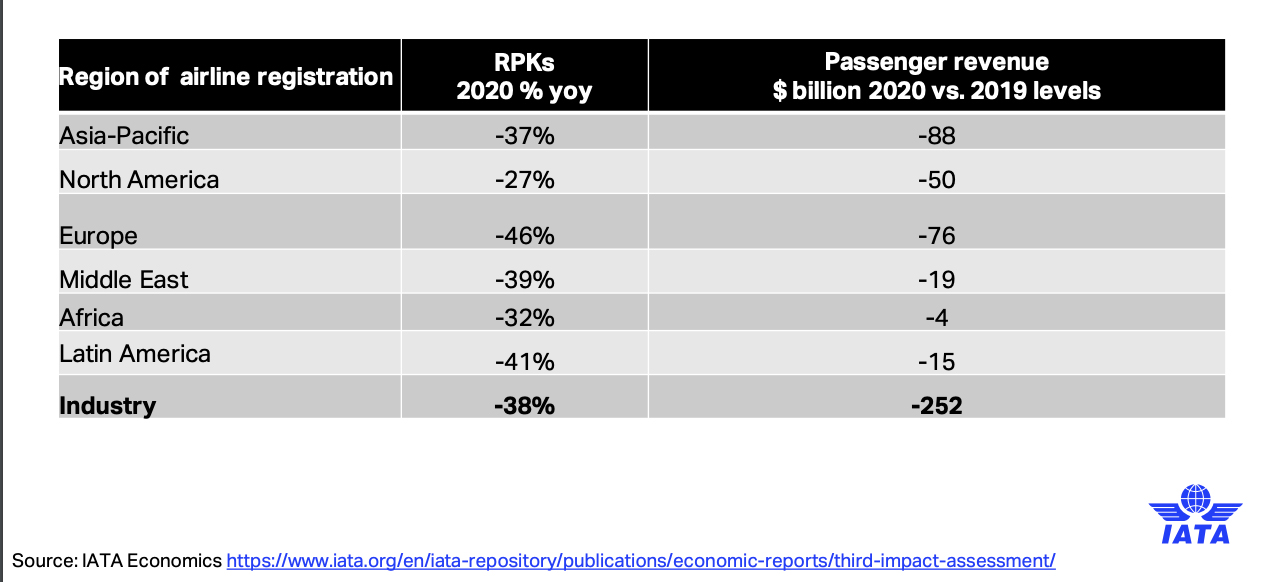

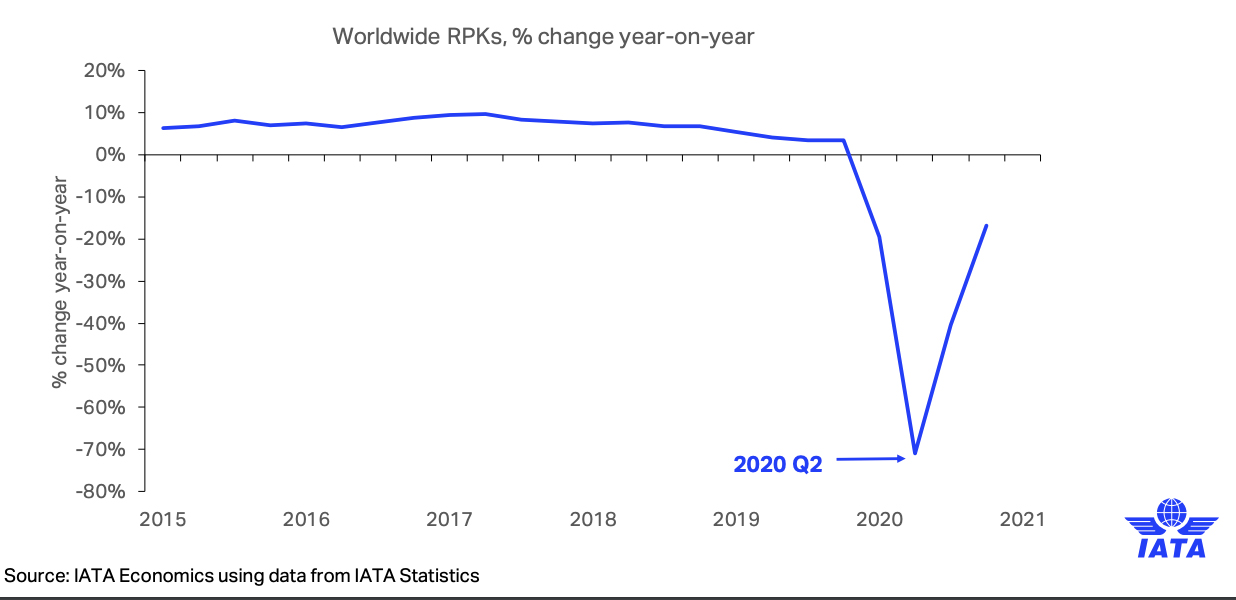

The IATA has estimated a passenger revenue drop of US$252 billion this year over last, if the current severe passenger restrictions last for three months. In this scenario, the second quarter would be the one with the lowest demand, with a 71% drop over Q2 2019.

$252 billion PAX revenue loss expected in 2020

Because of continued cargo demand, revenues are expected to come in at -68% for the quarter.

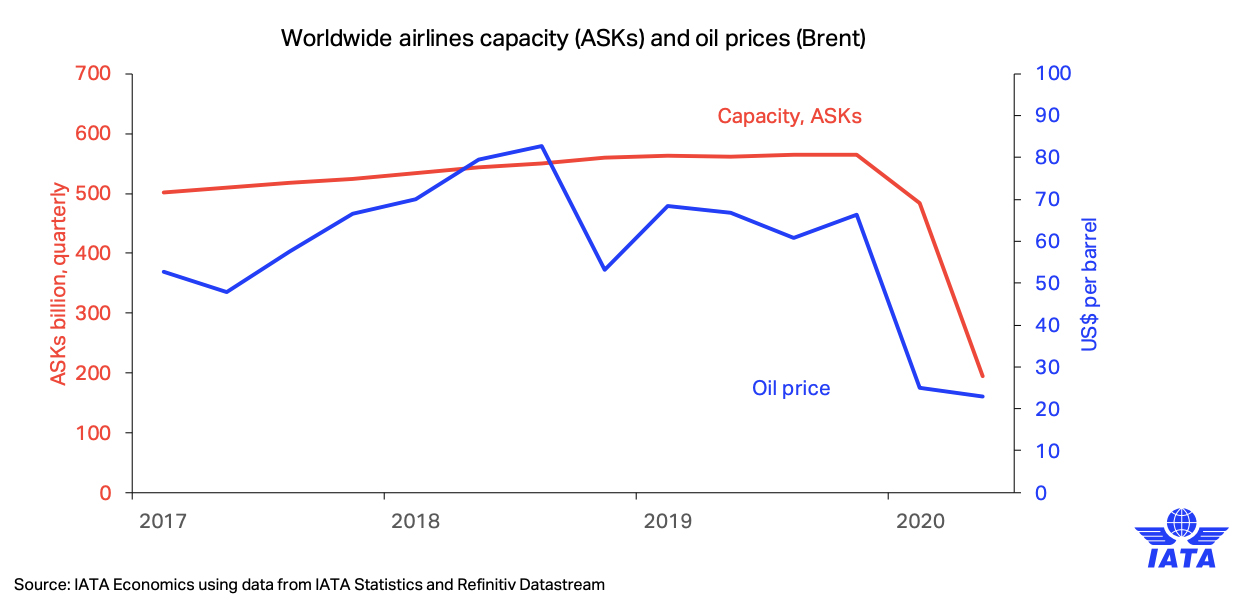

Variable costs can be reduced sharply, as much capacity has been grounded and fuel prices have collapsed

While variable costs are expected to fall off sharply — because of reduced demand and greatly reduced fuel costs — fixed and semi-fixed costs are expected to remain significant. Airlines are cutting in these areas as they are able to without compromising future recovery.

Combining the reduced revenues with reduced costs results in an estimated net loss of $39 billion in the second quarter, but this does not take into account the refunds airlines must make for tickets that had been sold for flights cancelled as a result of government-imposed restrictions on travel. These refunds will total US$35 billion in Q2. In all, the IATA expects airlines to burn through US$61 billion in cash during the second quarter to June 30, 2020.

38% fall expected in average 2020 RPKs based on this profile

“Travel and tourism is essentially shut down in an extraordinary and unprecedented situation. Airlines need working capital to sustain their businesses through the extreme volatility. Canada, Colombia, and the Netherlands are giving a major boost to the sector’s stability by enabling airlines to offer vouchers in place of cash refunds. This is a vital time buffer so that the sector can continue to function. In turn, that will help preserve the sector’s ability to deliver the cargo shipments that are vital today and the long-term connectivity that travelers and economies will depend on in the recovery phase,” said Alexandre de Juniac, IATA’s Director General and CEO.

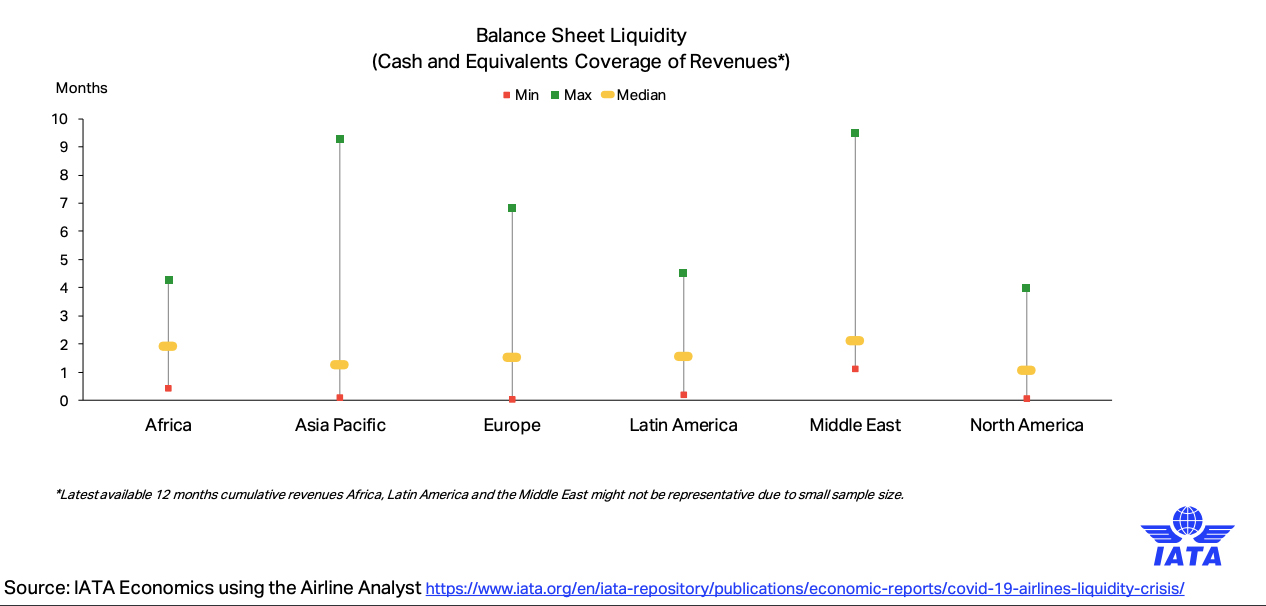

The risk is that airlines may run out of cash before recovery arrives. The typical airline had two months of cash at the start of this year

“When borders are closed and people’s mobility is limited by governments, our business disappears. And, of course if we cannot move people, that impact is felt across the economy, not least of which in the tourism sector.

“So it is good news when governments come to the table with relief measures. The biggest one since our last call was the $2 trillion package in the US that included over $50 billion for airlines and their employees. Colombia, Singapore, Australia, China, Norway and New Zealand are also among governments that have taken specific relief measures.

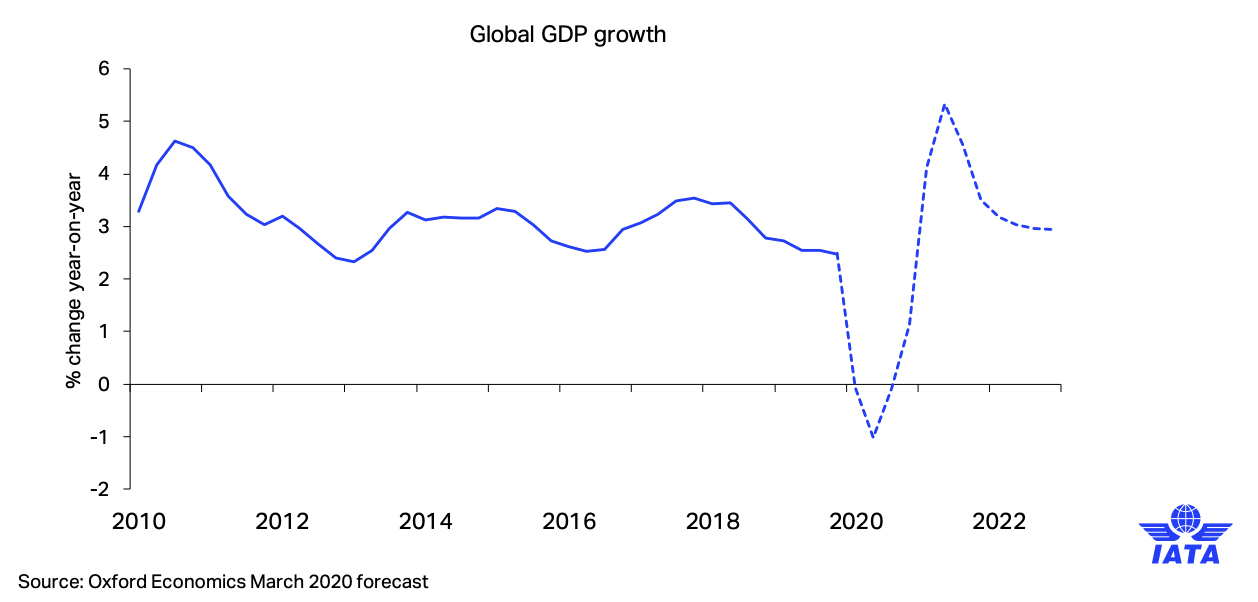

Deep economic recession will delay traffic recovery, but fiscal and monetary stimulus should generate strong rebound in 2021

“And a few governments—Brazil, Canada, Columbia, Italy and the Netherlands—have also addressed a key weakness that has emerged. The massive restrictions that governments have imposed on movement means that massive numbers of flights have been cancelled, creating a huge refund liability.

“Brazil, Canada, Colombia, Italy and the Netherlands have decided to allow airlines to issue vouchers in place of refunds. This will enable airlines to preserve the cash that they need to keep cargo operations running and preserve their ability to be fully operational when we can safely re-start the industry.

An estimated $35 billion of ticket refunds will be necessary in 2020 Q2 unless governments allow for vouchers

“These governments have taken an extraordinary measure in extraordinary circumstances. And it will provide a vital buffer period for airlines to keep operating. I cannot stress how important that is. When the public health crisis abates to the level where it is safe re-start the economy, the airlines must be ready to go. The recovery will be slower and much more painful if airlines are not able to support trade and tourism.”

.jpg?&resize.width=322&resize.height=483)