DFWC highlights impulse shopping in 2023 Q3 KPI Monitor

Global shoppers are increasingly purchasing on impulse according to the Duty Free World Council’s (DFWC) 2023 Q3 KPI Monitor.

Impulse purchasing has increased for the second consecutive quarter, with a 3% rise from 27% of shoppers purchasing on impulse in duty free shops, to 30% in Q3. This follows a 4% rise between Q1 and Q2 this year.

The quarterly monitor, produced for the Council by leading industry travel and travel retail research agency m1nd-set, shows that there has been no change in the specific planning behavior, but a decline in the percentage of shoppers who plan which product they wish to purchase.

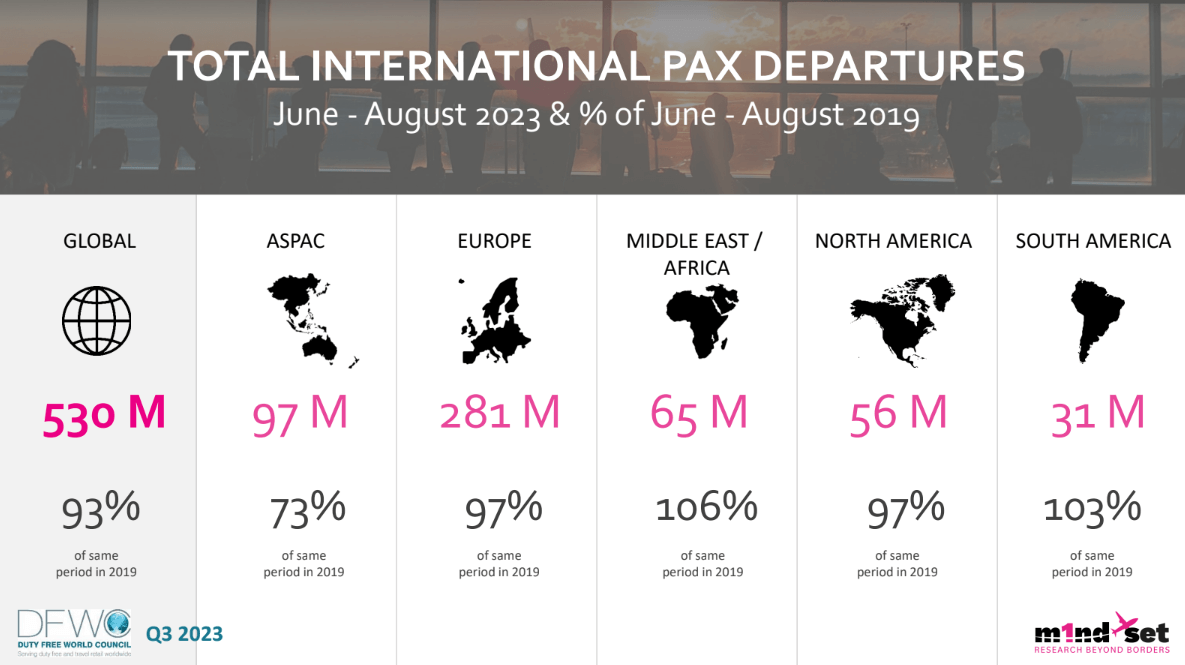

The 2023 Q3 KPI Monitor highlights international pax departures

While self-purchasing saw a 5% increase between Q1 and Q2, global shoppers were less self-centered in their purchasing behavior over the months between July and September. The tendency to purchase for oneself declined by 8 points, from 58% in Q2 to 50% in Q3. Gift purchasing during this period increased by 2% to 27%, and purchases for sharing rose 3 points, up to 16%. Shoppers also purchased more following requests from friends and family during Q3 this year. On-request purchases rose from 4% in Q2 to 8% this quarter.

Another marked change between Q2 and Q3 this year is the tendency to search for information about the shopping offer before purchasing. The Monitor reveals a 6% increase in this trend, with 21% of shoppers stating they actively search online for information about the duty and tax free shopping offer compared to 15% in Q2.

There is little movement since last quarter across the other main touch points prior to shopping, except for ads and billboards seen at the airport, which has seen a 2% increase from 14% to 16% in Q3.

Commenting on the findings, Dr. Peter Mohn, CEO and Owner of m1nd-set, said, “While we saw little movement in the exposure to touch points in general except for those searching online, we are seeing a general decline in the number of shoppers who are exposed to touch points prior to travelling or shopping. This declined by 4% between Q2 and Q3 this year with less than one third of shoppers now exposed to information about the duty and tax free shopping offer. This means greater efforts are required to reach the travelling consumer prior to departure with messages tailored to their individual profile.

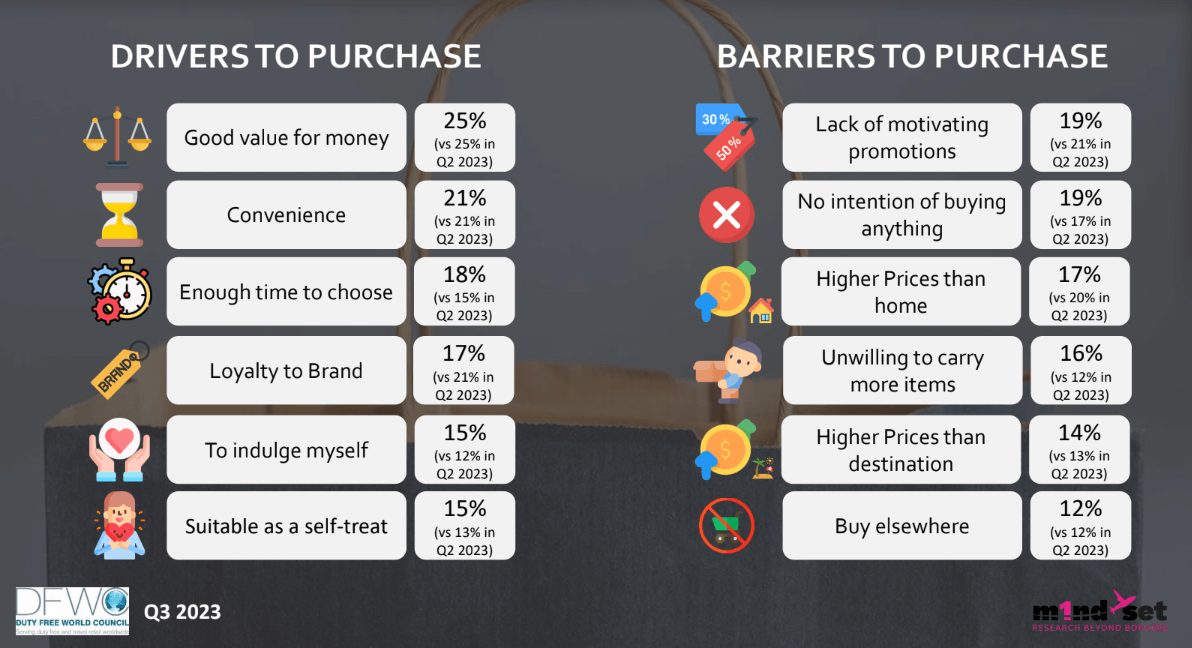

The 2023 Q3 KPI Monitor also spotlighted purchase drivers and barriers

“We also see a decline in the number of shoppers interacting with staff over the last quarter,” Mohn added. “Despite the decline in the number of interactions, the fact that the impact of staff interaction is increasingly positive underlines the need to ensure sales staff and brand ambassadors are more proactively engaging with shoppers.”

Based on data from m1nd-set’s Business 1ntelligence Service (B1S), supplied by IATA’s comprehensive Direct Data Solutions (DDS) air traffic database and forecasting tool, the monitor reveals the top 5 airports for international departures between June and August this year are all in Europe except for one – Dubai. Heathrow saw just over 12.25 million departing international passengers between June and August this year, with Dubai at 12.16 million. Paris Charles De Gaulle and Amsterdam follow in third and fourth place with just over 10 million passengers for Paris CDG and around 10 million for Schiphol, while international departures at fifth-ranking Frankfurt Airport were just below 9 million passengers.

The leading nationality for international departures across all airports is, by a significant margin, the US. More than 53 million US travelers departed internationally around the world in Q3 this year, while 45 million Brits took to the skies in Q3, placing the UK in second place for international departing nationalities. Germany, France and Italy complete the top 5 nationalities with 34.8, 25.7, and 21.6 million departures respectively, according to the DFWC KPI traffic monitor.

Commenting on the Monitor findings, DFWC President, Sarah Branquinho said, “It is encouraging to see that global air traffic has been consistently increasing over the past three quarters and reaching closer to the pre-pandemic levels of 2019. Global air traffic is now only 7% short of 2019 levels in Q3, which is a big improvement on Q1. Understandably, Asia Pacific is still trailing the furthest behind, but air traffic from the Middle East and South America are now both ahead of 2019 levels. The return to normality must be accompanied by additional efforts on staff engagement.

“We look forward to seeing more retailer staff and brand ambassadors joining the DFWC Academy and following the various courses the Academy proposes to ensure a better understanding of the traveler mind-set. This will contribute to improving in-store interactions between staff and shoppers and, consequently, increased sales performance,” Branquinho concluded.