m1nd-set reveals regional shopper behavior analysis

Travel retail research specialist m1nd-set has launched a new region-by-region analysis of the post-pandemic shopper psyche.

The two-part research report, entitled "Why they buy and what they buy (part 1)", illustrates not only the numerous factors that influence shoppers to make the purchase but also what they purchased and for which purpose.

In part one, m1nd-set studies the shopper behavior in travel retail among travelers from the Middle East and Africa (MEA) as well as across the Asia Pacific region. Part two, released next month, will examine how travelers from Europe and the Americas are being influenced to purchase as well as their purchase behavior.

The major determining factor into whether shoppers will purchase more, less, the same or not at all is financial. Covid has impacted many consumers in a negative way in terms of purchasing power. This is particularly true for all tourism-related businesses as well as small businesses which require face-to-face interaction such as bars and restaurants. There are also many businesses that have profited from the pandemic.

This variable financial impact of the pandemic is evident also in shopper behavior among consumers as they resume international travel. When asked whether they have been impacted positively or negatively by the pandemic, 59% of travelers from both the MEA and Asia Pacific regions said they had been impacted negatively, higher than the global average of 55%. Moderately fewer travelers from the MEA region said they had been impacted positively (16%), than did travelers from the Asia Pacific region (18%).

Consequently, purchasing power and shopping behavior have both been impacted in turn. Travelers from both the MEA and Asia Pacific say they are spending less as a result of the pandemic; with 56% of MEA travelers saying they are spending less and 54% in Asia Pacific, which is greater than the global average of 50%.

Spending on discretionary items such as skincare, alcohol, gifts, perfumes and chocolate has been reduced by 40% of travelers from Asia Pacific and 45% of those from the MEA, significantly higher than the global average of 35%.

Around 6 out of 10 travelers from both Asia Pacific and the MEA region say they will spend less time at the airport on future trips, while only one fifth of travelers from both regions say they will spend more time.

Shopping drivers and influencers in travel retail

Footfall in the duty free shops is the highest globally among international travelers from the MEA region at 45%, while it is the lowest among those from Asia Pacific at 36%, compared to the global average of 39%. Generally, the lower the footfall, the greater the need to communicate to international travelers before the trip about what the offers and opportunities such as travel retail exclusives are available in-store, to give shoppers a reason to visit the stores.

When looking at conversion rates, however, m1nd-set sees the opposite trend. Travelers from the Asia Pacific, who visit the duty free shops, tend to shop more than those from any other region with a 65% conversion rate, while travelers from the MEA region have one of the lowest conversion rates globally at 54%, compared to the global average of 56%. This invariably means there is a greater need to engage with these low converters in store to influence the purchase.

Visitor trends

When we look at what drives travelers from Asia Pacific and the MEA region to visit the stores there is a higher-than-average tendency for Asia Pacific travelers to visit because of the price advantage (33% vs 29% global average), because they saw a promotion outside the store (23% vs 19%), the promotional area within the store (21% vs 17%) because they had planned to purchase a gift for someone (24% vs 22%) or treat themselves (21% vs 18%) as well as because of the products and brands on display (20% vs 18%).

The impact of these promotional aspects demonstrates the importance of marketing activities to attract visitors inside the stores, and highlights the need to create an engaging, enticing experience. For travelers from the MEA region, price advantage, promotions and gifting are the most significant drivers for visiting the shops. 30% of MEA regional travellers say they visit because of price advantage compared to the global average of 29%, 26% to look for promotions versus 23% globally and 28% for gifting versus 22% globally.

Planned vs impulse purchase trends

85% of shoppers from Asia Pacific planned their purchases, either partially or with a specific product or brand in mind while 15% of shoppers from the region purchase on impulse. 9% of shoppers from the region planned to purchase a specific brand and 5% a specific product. 71%, however, planned their purchases only partially with only some idea of product and budget, meaning that in store engagement, whether through the sales staff or in-store marketing, will be a determining factor in influencing the purchase. For shoppers from the MEA region, 19% purchase on impulse while 17% planned to purchase either a specific brand (10%) or product (7%) and 64% of MEA shoppers are more undecided and planned only partially.

In terms of reasons to purchase, MEA regional shoppers tend to purchase more than the global average across most of the drivers, in particular because of value for money in the duty free shops (41% versus 37% globally), buying souvenirs (24% versus 21%), the product is unavailable at home (27% vs 25%) and following staff advice (25% versus 20% globally). For Asia Pacific shoppers, the reasons for purchasing which are most significantly higher than the global average are to purchase promotions (27% versus 25%), the product is unavailable at home (27% vs 25%) and souvenirs (26% versus 21%).

The importance of online touch points

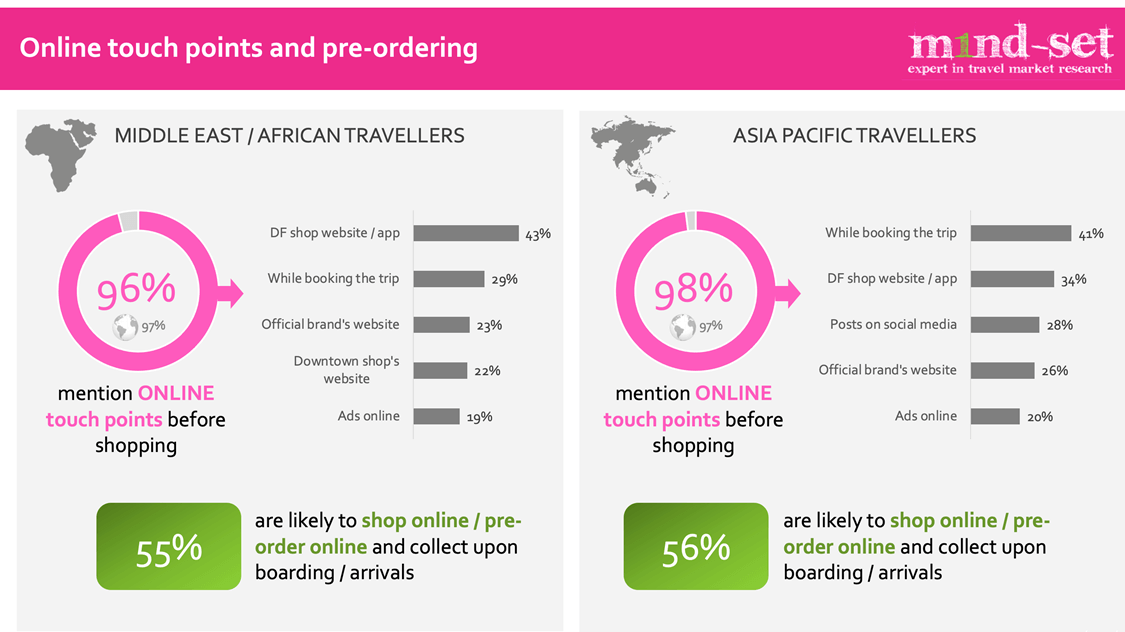

Online advertising and promotions seem to be the most viewed among all communications touchpoints as almost all travelers from both regions say that they have seen adverts online. Among the online touchpoints where they encountered the promotional information 43% of MEA shoppers and 34% of Asia Pacific shoppers say it was on the duty free shop website, 29% of MEA shoppers and 41% for Asia Pacific shoppers while booking the trip and 15% of MEA shoppers versus 28% of Asia Pacific shoppers via posts on social media.

Adverts and information were also seen on the brands’ official website and via online advertising. Nearly 8 out of 10 shoppers from both the Asia Pacific and MEA regions compare prices, with one fifth of MEA travelers and one quarter of Asia Pacific travelers comparing prices online.

When asked about their plans to pre-order and purchase from the duty free shops’ websites, just over half of shoppers from both regions (55% for the MEA region and 56% for Asia Pacific) said they would use the website for some of the purchases while around one third (31% for the MEA and 34% for the Asia Pacific region) said they would use it for most of their purchases.

One of the key shopping influencers, particularly among Asia Pacific shoppers, is the sales staff. 80% of shoppers from the region say they were either approached by the sales staff (45%) or approached the staff themselves (35%). This is significantly higher than the global average of 71% and compared to MEA region shoppers. 33% of shoppers from the MEA region say they approached staff for advice, while 40% were approached by the sales staff. In terms of impact of the sales staff, 75% of shoppers from both the MEA and Asia Pacific regions say they were positively influenced by the sales staff, which is lower than the global average of 80%.

In terms of actual purchasing behavior influenced by purchase drivers such as promotions and travel retail exclusives, their importance is clearly evident across both regions. 55% of shoppers from the MEA region and 52% from Asia Pacific said some or all the products they purchased were travel retail exclusives, higher than the global average of 45%.

The impact of promotions is even greater, particularly among Asia Pacific shoppers, 76% of whom purchased products on promotion in the duty free shop. This is higher than the global average of 73%, while for MEA region shoppers, the impact of promotions remains strong albeit slightly lower than the global average, with 66% purchasing promotions. As for the novelty factor, three out of four Asia Pacific shoppers purchased some or only products they had never purchased before, which is higher than for shoppers from the MEA region (69%) and the global average of 72%.

Turning to the actual shopping behavior, including categories visited, purchased and spend levels, there is little variation in terms of the number of categories visited across all world regions from the global average of 2.8.

Asia Pacific travelers have a higher-than-average tendency to visit Skincare (32% vs 25%), Souvenirs & Gifts (31% vs 24%) Make-up (25% vs 22%) and Toys (14% vs 13%). The categories for which they have a lower-than-average tendency to visit are: Perfumes (38% vs 40%), Alcohol (28% vs 30%), Tobacco (20% vs 25%) and Confectionery (22% vs 27%). For Fashion & Accessories, Electronics, Jewellery & Watches, the tendency to visit is in line with the global average.

For travelers from the MEA region on the other hand, they have a higher-than-average tendency to visit Perfumes (43% vs 40%), Tobacco (26% vs 25%), Souvenirs & Gifts (26% vs 24%), Fashion & Accessories (33% vs 24%), Confectionery 27% vs 24%) and Jewellery & Watches (25% vs 20%). The categories for which they have a lower-than-average tendency to visit are: Alcohol (26% vs 30%), Skincare (20% vs 25%), Make-up (25% vs 22%) and Electronics (18% vs 21%). The tendency to visit is in line with the global average only for Toys among MEA region shoppers.

For both the MEA region and Asia Pacific, average spend on the last international trip in the duty free shops was 10% higher than the global average (circa US$185 compared to US$168). Shoppers from both regions tend to purchase more categories than the global average.

Future outlook for MEA and Asia Pacific regions

The outlook for traffic growth resumption is more dynamic in Asia Pacific than it is for the Middle East and Africa. In Asia Pacific traffic will reach 69% of the pre-Covid 2019 level by 2023, according to the m1nd-set Business 1ntelligence Service (B1S) traffic analysis tool, in partnership with IATA.

However, despite the lower numbers overall, the percentage values are not too dissimilar for the Middle East and Africa. By 2023, traffic in the Middle East will have reached 58% of the 2019 level and in Africa, 64%.