Europe’s traffic revival sends positive signal for travel retail, finds m1nd-set

European traffic growth and ticket sales over the current summer period point to a healthy revival for both travel from to and through Europe, according to m1nd-set’s latest regional travel and shopper research.

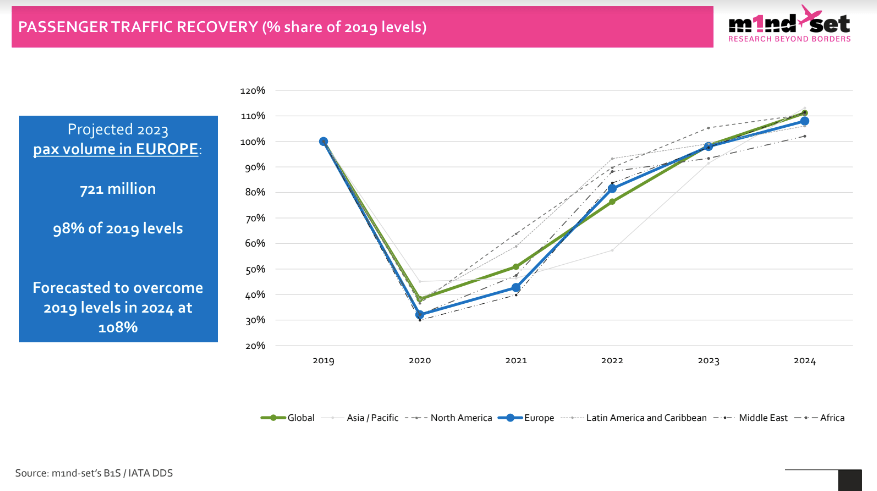

According to the Swiss research agency, despite the challenging economic and geopolitical context, recent traffic growth, current ticket sales and traveler trends indicate that Europe will enjoy positive growth this year, falling just short of 2019 performance and surpassing pre-pandemic levels in 2024. Citing data from m1nd-set’s Business 1ntelligence Service (B1S) and IATA’s comprehensive air traffic database DDS, the research agency reveals that air ticket sales for the main vacation period between May and September are at 91% of pre-pandemic levels, which is slightly below the global average of 92%.

“Although the current summer travel period shows below-average performance at 91%, if we look at the full year, we can see Europe’s performance will improve," says m1nd-set CEO and owner Dr. Peter Mohn. "Standard economy class ticket sales, representing 89% of total ticket sales, will reach around 98% of the pre-pandemic level, in the full year 2023, which is higher than the global average of 97%. Premium class travel however, which represents around 11% of ticket sales in Europe, will surpass the pre-pandemic level in 2023, reaching 123% of the 2019 figure. This is excellent news for the travel retail channel, because our data shows that premium class travelers spend significantly more compared to standard economy class passengers."

Chart: Passenger traffic recovery

Chart: Passenger traffic recovery

European airports are set to see strong growth among European travelers in 2023 according to m1nd-set, which will see a shift in the rankings of the major global airports in terms of international departures by European travelers. In the first quarter of this year, m1nd-set reports that five out of the top ten airports were in Europe, while for the remainder of the year, the top ten rankings will see a shift with seven out of the top ten airports for international departures among Europeans based in Europe. London Heathrow is set to take the top spot with 2.7% of all international departures by European travelers, Amsterdam Schiphol will take second place with 2.4% and Frankfurt third place, with 2.2%. Paris Charles De Gaulle and Dubai Airports will be in fourth and fifth place respectively over the next six months, and London Gatwick Airport will enter the top ten into sixth place. Madrid will climb from ninth to eighth position and Munich Airport will enter the top-ten rankings into ninth position.

The latest regional research from m1nd-set also highlights the recent trends and evolutions among the European traveler and shopper profiles underlining how Europeans are shopping, and how the trends have evolved from the first to the second quarter in 2023.

“Footfall and conversion rates among European international travelers are in line with the global average, although this does vary when going into more depth, comparing across the various shopper segments," said Mohn. "Looking at all European shopper profiles combined though, we see that 45% of travelers visit at least one shop during their trip, which is the same as the global trend. It’s encouraging to see that 55% of visitors to the shops among European shoppers purchased in Q2 2023, which is 2% higher than in Q1.”

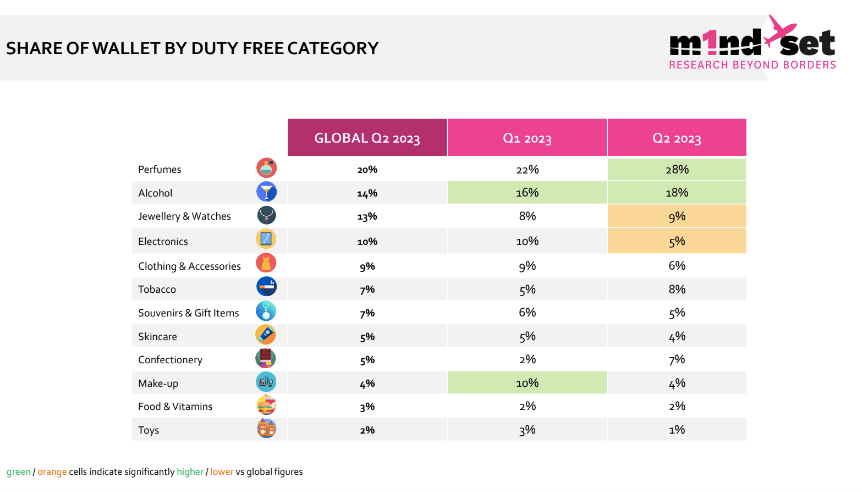

Confectionery, Perfumes and Alcohol are the clear leaders in terms of categories purchased in Q2 2023, all of which are above-average compared to the global average, according to m1nd-set. As for share of wallet, the m1nd-set research indicates that the Perfumes category draws the highest spend with 28% of European shoppers’ duty free shopping budget in Q2 2023, which is significantly higher than the global average of 20%. Alcohol also demonstrates above-average performance with 18% share of wallet among European shoppers, compared to 14% among global shoppers.

Chart: Share of wallet by duty free category

Chart: Share of wallet by duty free category

The purchase destination among European shoppers reveals a moderate decline in self-purchases between Q1 and Q2 this year, according the m1nd-set research with 54% of Europeans purchasing for themselves in Q2 compared to 56% in Q1, both of which are below the global average of 58% in Q2. Gifting purchases on the other hand have seen a marked increase between the two quarters, jumping from 20% in Q1 to 28% in Q2, above the global average of 25%.

“The data is considerably more detailed and actionable when broken down by category, age segment, traveler profile, destination and departure airport," said Mohn. "When we link these more detailed shopper behavioral trends to current and forecast traffic trends on a nationality basis, or even at airport and airport terminal level, we see some very interesting current and future shopping trends for the specific categories and sub-categories, as well as for specific shopper segments.”