We need to improve APAC travel retail now: Guest post

The global travel retail industry is not limited to only airports; it also includes airlines, border shops, ports, cruise lines and ferries. However, airports still enjoy the pole position in the market and are expected to remain the dominant player in the coming years.

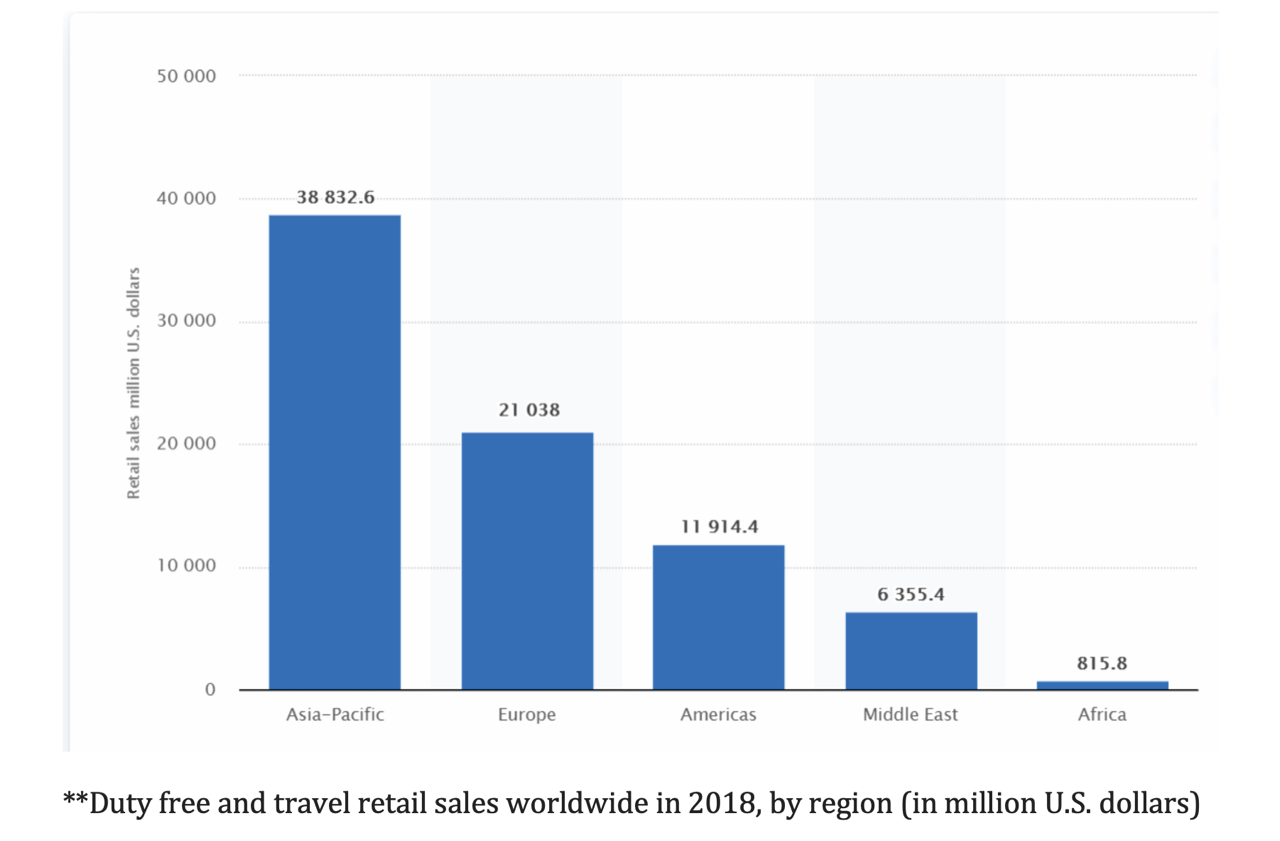

The duty free and travel retail market is projected to register a CAGR of greater than 7.5% during the forecast period, 2021-2026, due to the growing demand for retail chains that offer luxury and premium brands of various products. Airport duty free and travel retail, which are collectively regarded as one of the major non-aeronautical revenue generators, always depends on the tourism industry and regular travelers. When observing the sales figures related to the duty free and travel retail industry, one can see that the Asia-Pacific region is holding a major share of 45%+ from the total industry revenue.

In 2017, an estimated US$36.2 billion was spent on duty free and travel retail in the Asia-Pacific region. Airports and airlines accounted for nearly US$21.2 billion in duty-free and travel retail sales, of which 75% occurred in the sub-region of East Asia. Duty-free and travel retail spending in the Asia-Pacific region accounted for an estimated 140,900 direct jobs and US$7.6 billion in direct GDP.

The adoption of new lifestyles and the introduction of cheap destination travel packages by companies such as MakeMyTrip, Cleartrip and GoIbibo may be credited in part with the growth of the global duty free and travel retail market in the APAC region. Furthermore, the rapid penetration of social media and digitalization in the economy are expected to create lucrative opportunities for vendors operating in the Asia-Pacific market during the forecast period.

Countries such as Sri Lanka, India, Singapore, Maldives, Thailand and Malaysia have the potential to gain significant revenue in coming years from this market if due consideration is given to this source of non-aeronautical revenue. To capitalize on this opportunity and gain the maximum benefit, airport authorities in these countries need to develop a strategic plan targeting more travelers, improve tourism and promote and develop airport retail as a destination in and of itself to improve spend.

In short, to gain the most from these travelers, airports need to stop thinking like landlords and rather start thinking like customer experience companies.

Travelers are coming back, but their mindset is different. Travel retailers need to understand the new traveling consumer

Borders are beginning to open and passengers are cautiously stepping back into the airport with their facemasks on. But behind the masks are significant changes in mindset and behavior. These changes demand a response from airports and retailers, especially in the digital realm. We can expect more and more passengers to rely on digital for information and for their shopping needs in days to come. A digital foundation provides main revenue drivers such as:

- Acquiring the new digitally focused consumer

- Retention, by providing deeply personalized communication

- Selling digitally through a wide range of choice

Airports bring infrastructure to the party, airlines bring the customers and retailers bring the products, while the brands sprinkle their gold dust of attraction and excitement. Travel retail can be redefined and reinvigorated, but only if the partnership mechanics are redefined for tomorrow.

With international tourist arrivals to Asia Pacific not expected to reach their pre COVID-19 levels until at least 2023, finding new revenue streams through different strategies is crucial for the region’s duty-free and travel retail market, according to a report from GlobalData.

Two notable examples are:

- China’s travel retail was able to recover quickly due to favorable duty-free shopping policies introduced in Hainan

- South Korea began allowing non-destination flights, allowing the same duty-free shopping allowance was allowed for passengers to buy as in normal international flights

Vaccination uptake is high among frequent travelers

Given their desire to return to the skies again at the earliest, frequent travelers appear more likely to take the vaccine and possibly have gone through their vaccine series.

Frequent travelers are often the first to queue up to get their vaccines

Also we see a new trend emerging in some parts of the world, and that is traveling for the purpose of receiving a vaccine. In the US in particular we see the emergence of vaccine tourism. While this was at first discouraged, airports are now making it easier for these vaccine tourists. Authorities in APAC also should consider vaccine tourism under special guidelines and through special travel bubbles, provided they are able to procure enough vaccines.

Yasith Amarasinghe has been working as the Senior Category Manager for Liquor & Tobacco at Flemingo Duty Free Sri Lanka since 2014

Work together to benefit all

Initiatives from local governments, airports and travel retailers will help duty free and travel retail players to remain afloat during these testing times and generate revenue. The industry needs to develop its partnership strengths, break out of its silos with an aim of creating what we call “one platform, one experience,” transforming airports into powerful lifestyle brands and transport hubs, destinations in themselves.

From competition to collaboration. Let’s play our role responsibly for the betterment of airport travel retail industry in APAC.

.jpg?&resize.width=322&resize.height=483)