Safilo Group S.p.A. reports preliminary 2022 key performance indicators

The Board of Directors of Safilo Group S.p.A. has reviewed the Group’s preliminary key performance indicators for the financial year ended December 31, 2022. The full year annual results will be approved by the Board of Directors on March 9.

With regards to the ongoing strategic analyses and taking into consideration the evolution of the product portfolio, the economic context, the competitive dynamics and a persistent production overcapacity, the Board of Directors, in reiterating the importance of the Santa Maria di Sala and Bergamo production sites, of the Padua logistic center, and the company's creative capabilities, has given the management a mandate to explore alternative solutions for the Longarone plant the content of which will be better outlined in the coming weeks, reads the press release.

The details

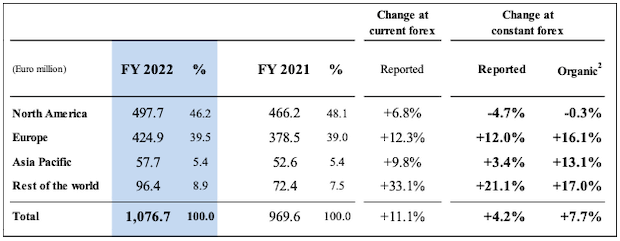

In 2022, Safilo's preliminary net sales amounted to €1076.7 million (US$1166.6 million), up 11.1% at current exchange rates and 4.2% at constant exchange rates compared to €969.6 million (US$1051.3 million) recorded in 2021.

In the year, organic sales grew by +7.7% at constant exchange rates, recording another significant improvement after the +10.5% achieved in 2021 compared to 2019. Own brands represented an important driving force behind the Group’s overall performance, in particular Smith, which with another strong increase in sales confirmed its position as one of the leading brands in the rapidly growing segment and distribution channel of outdoor eyewear and sports products. Carrera and Polaroid also posted yet another year of double-digit growth, broad based by distribution channel and product category, with Carrera far exceeding pre-pandemic levels.

Safilo’s licensed business also delivered very solid growth in the year, thanks to the positive development achieved by the eyewear collections of its leading licensed brands, and to the inclusion of new licenses in the portfolio which effectively contributed to offset the sales recorded in 2021 with the discontinued business.

By geographical area, Europe remained in 2022 the key growth driver, with the main markets of the area and the surging business in Turkey and Poland, contributing to the upside in revenues of 12.3% at current exchange rates, +12.0% at constant exchange rates and +16.1% at the organic sales level.

During the year, the North American market benefited from the strengthening of the dollar against the euro, closing up 6.8% at current exchange rates. The performance at constant exchange rates, in total down by 4.7%, was instead flattish versus 2021 at the organic sales level (-0.3%), reflecting a challenging basis of comparison, especially in the second half of the year.

Safilo reported very positive sales trends also in the Rest of the World, composed of the business in the IMEA and Latin American countries, as well as in Asia and Pacific, with the two areas respectively up 33.1% and 9.8% at current exchange rates, +21.1% and +3.4% at constant exchange rates, and +17.0% and +13.1% at the organic sales level.

FULL YEAR 2022 PRELIMINARY NET SALES PERFORMANCE BY GEOGRAPHY:

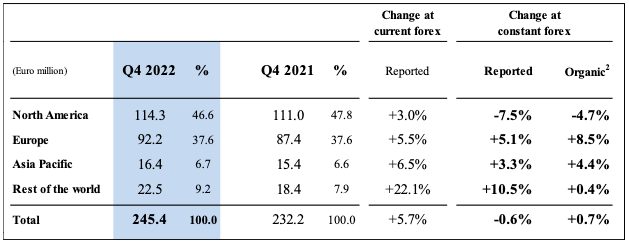

In Q4 2022, Safilo's preliminary net sales amounted to €245.4 million (US$266.08 million), up 5.7% at current exchange rates and substantially in line with the business recorded in Q4 2021 at constant exchange rates (-0.6% reported and +0.7% at the organic sales level). The quarter confirmed the strength of the Group’s business in Europe, which grew by 5.5% at current exchange rates, +5.1% at constant exchange rates and by a resilient +8.5% at the organic sales level notwithstanding the significant and expected contraction of the revenues generated through the GrandVision chain.

In North America, total sales were up 3.0% at current exchange rates and down 7.5% at constant exchange rates. At the organic level, the business softened by 4.7% mainly due to the tough comps base with the +19.7% recorded in Q4 2021 vs. ’19, and a softer US wholesale demand in the entry and mid-tier price points, while the premium and upper-end segments continued to hold up well. On the other hand, Smith posted a double-digit growth in the quarter, recovering the large part of the logistics delays impacting deliveries in the US sport shops channel in Q3, and also Blenders turned back to growth posting a positive quarter, with its online business back to a double-digit upside.

Q4 sales trends remained supportive in Asia and Pacific, up 6.5% at current exchange rates, +3.3% at constant exchange rates and +4.4% at the organic level, as well as in the Rest of the World thanks to a solid business development in IMEA, and the new brands in the portfolio well supporting growth in the key Latin American markets (+22.1% at current exchange rates, +10.5% at constant exchange rates and +0.4% at the organic level).

Q4 20222 PRELIMINARY NET SALES PERFORMANCE BY GEOGRAPHY:

On a preliminary basis, Safilo closed the full year 2022 with an adjusted earnings before interest, taxes, depreciation, and amortization of around €101 million (US$109.5 million), and a margin on sales of approximately 9.4% (10.3% ex IFRIC SaaS impact). Whilst slightly below management's expectations, the report said 2022 adjusted EBITDA corresponds to an increase of around 24% compared to €81.5 million (US$88.3 million) recorded in 2021, and to a margin improvement of 100 basis points compared to the 8.4% margin posted the year before.

"On a preliminary basis, the Group's net debt as at December 31, 2022 stood at around €113 million (US$122.5 million) (around €70 million [US$75.9 million] pre-IFRS 16, corresponding to a financial leverage, also pre IFRIC SaaS, of 0.7x), slightly better than the position of €115 million (US$124.6 million) reported at the end of September 2022 (€67 million [US$72.6 million] pre-IFRS 16, corresponding to a financial leverage, also pre IFRIC SaaS, of 0.7x) and slightly above €94 million (US$102 million) recorded at the end of 2021 (€52.8 million [US$57.2 million] pre-IFRS 16, corresponding to a financial leverage, also pre IFRIC SaaS, of 0.7x).

.jpg?&resize.width=322&resize.height=483)